Electrical and electronic industry, industrial electricity and household electricity; Production of electrical and electronic equipment and electronic components (including stages according to the Project’s closed production technology such as painting, spraying, electroplating, cleaning metal surfaces with chemicals, etc.);

– Electronics, information technology, information technology, telecommunications industry (including stages according to the Project’s closed production technology such as painting, spraying, electroplating, cleaning metal surfaces with chemicals, etc.);

– Industry of manufacturing, repairing, assembling motorbikes, cars, tractors and other means of transport (including stages according to the Project’s closed production technology such as painting, spraying, electroplating, cleaning metal surfaces with chemicals, etc.);

– Mechanical industry, precision mechanics; medical equipment (including stages according to the Project’s closed production technology such as painting, spraying, electroplating, cleaning metal surfaces with chemicals, polishing metal, etc.);

– Construction steel and steel pipe manufacturing industry (including stages according to the Project’s closed production technology such as painting, electroplating, cleaning metal surfaces with chemicals, polishing metal, etc.; no casting, no smelting);

– Wood furniture manufacturing industry, interior decoration; wood processing, wood chips from natural wood; construction materials (no cement production, no clinker production, no lime production); paint used in construction;

– Ceramic, glass, crystal industry.

– Plastic industry (no recycling of plastic scrap only to produce plastic granules; no production of plastic products from scrap with cleaning stages such as bleaching, rinsing, washing at the Factory);

– Rubber industry (no processing of rubber from fresh latex, no recycling of rubber).

– Chemical and plastic production industry; plastic products, paint;

– Paper production industry (no production of pulp from wood and non-wood raw materials); paper products, packaging, plate making, printing. Particularly for paper production projects using scrap paper as raw material, IDICO Corporation must have a written report, requesting acceptance of each specific project, sent to the Department of Natural Resources and Environment to preside over, coordinate with relevant departments, branches, and localities to consider, report, and propose to the Provincial People’s Committee for implementation policy;

– Textile and garment industry (no dyeing, no bleaching, no washing and grinding);

– Production of leather products (no tanning);

– Food, foodstuff, animal feed processing industry (no using fresh materials); beverage production;

– Pharmaceutical manufacturing industry;

– Industry producing cosmetics, industrial chemical additives;

– Industry producing veterinary drugs, manufacturing pharmaceutical ingredients (including pharmaceutical ingredients and excipients);

– Industry producing sports equipment, toys, jewelry;

– Manufacturing tools, supplies, stationery equipment (excluding industries related to printing ink).

– Manufacturing products for agriculture; manufacturing, mixing fertilizers (excluding pesticides);

– Industry producing and distributing electricity, solar power;

– Manufacturing and distributing gas, industrial gas, medical gas; hot water, steam, industrial steam (hot steam, thermally saturated steam);

– Gasoline distribution and trading stations;

– Manufacturing, blending, storing lubricants (not using waste lubricants);

– Logistics services, storage of goods, warehouses, storage yards, cold storage;

– Renting warehouses and pre-built factories with industries in accordance with the approved industrial park industry.

– Biotechnology; nanotechnology; production of new materials;

– High-tech agricultural industry;

– Center for research, development, and technology application.

– Advertising, displaying, introducing, and trading products;

– Food and beverage services, utilities in the industrial park serving investors.

Investment incentives policy

Corporate income tax rate: 20%

Tax incentives:

– Preferential tax rate is 17% for 10 consecutive years from the first year the enterprise has revenue from the project. After the period of application of this preferential tax rate, the enterprise switches to applying the tax rate of 20%.

Tax exemption for 2 years and 50% reduction for the next 4 years from the time of taxable income.>

The tax exemption and reduction period is calculated continuously from the first year the enterprise has taxable income from the project;

In case the enterprise has no taxable income in the first three years (from the first year of revenue from the project), the tax exemption and reduction period is calculated from the fourth year.

Basis for determining tax incentives: Decree No. 218/2013/ND-CP dated December 26, 2013; No. 118/2015/ND-CP dated November 12, 2015.

Import tax: Enterprises are exempted from import tax on imported goods according to the provisions of Article 16 of the Law on Export Tax and Import Tax No. 45/2005/QH11 dated June 14, 2005 and Article 12 of Decree No. 87/2010/ND-CP dated August 13, 2010 of the Government detailing the implementation of a number of articles of the Law on Export Tax and Import Tax.

Investment incentives policy at Huu Thanh Industrial Park

Investment incentives policy at Huu Thanh Industrial Park

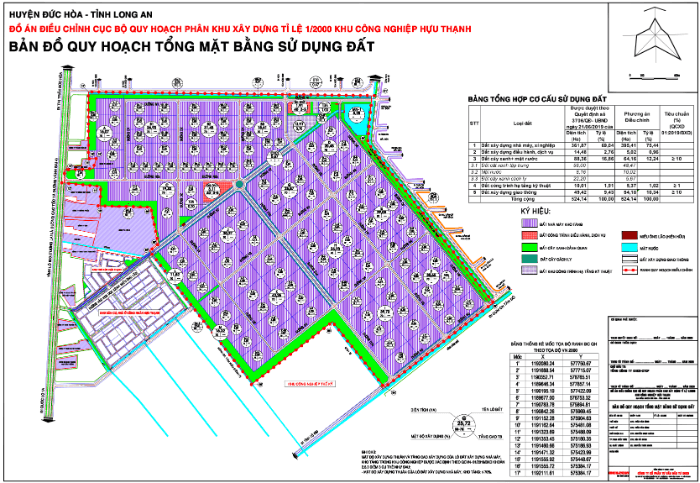

Project planning map of Huu Thanh Industrial Park

Download high quality file of industrial park planning map: Link

Review of Huu Thanh Industrial Park

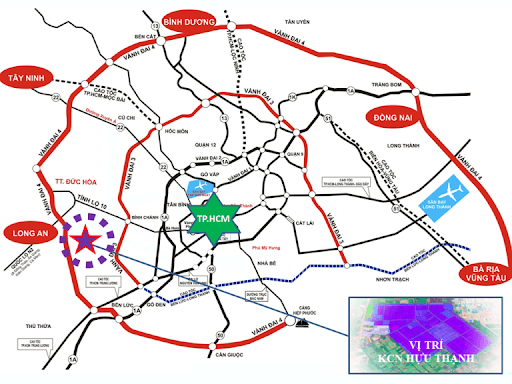

Huu Thanh IDICO Industrial Park is close to (adjacent to) Ho Chi Minh City, so it benefits from the traffic – urban expansion projects from Ho Chi Minh City.

Huu Thanh IDICO Industrial Park is easy to recruit labor: With its location close to (adjacent to) Ho Chi Minh City, located near a densely populated area, the industrial park is easy to recruit labor.

Huu Thanh IDICO Industrial Park has good land rental prices, very competitive compared to the surrounding area.

Huu Thanh IDICO Industrial Park has many investment incentives, especially incentives on corporate income tax:

+ The current general corporate income tax rate is 20%.

+ The corporate income tax rate applied in the first 10 years is 17%; From the 11th year is 20%.

+ Tax exemption for the first 2 years from the time of taxable income; 50% discount for the next 4 years.

Huu Thanh IDICO Industrial Park is convenient for industries producing consumer goods, light industries such as fibers, textiles, garments, footwear, food processing, etc.; electricity, household appliances, electronics – information technology; wood and furniture industries, etc.

Huu Thanh IDICO Industrial Park is an ideal location for relocating and expanding factories that have been operating for many years in Ho Chi Minh City and Bien Hoa 1 Industrial Park, Dong Nai Province.

A reputable industrial park investor in Vietnam with nearly 30 years of experience in the field of investment, construction and business of industrial park infrastructure in Vietnam.

Free care and support services for procedures for applying for Investment Registration Certificates and registering to establish enterprises; serve customers to the maximum, help customers quickly complete initial investment procedures and establish a production and business operation system in Vietnam.