[Dong Nai] Giang Dien Industrial Park

June 19, 2025Overview of Giang Dien Industrial Park project

Giang Dien industrial park is one of the key industrial park projects in the South of Dong Nai province in the early 20th century.

Construction started in 2008 with a total area of up to 529.ha. Giang Dien Industrial Park is one of 2 industrial parks in Dong Nai province planned for projects in the field of supporting industry in the area.

Project name: Giang Dien industrial park

Location: Giang Dien Commune, An Vien Commune, Trang Bom District and Tam Phuoc Commune, Bien Hoa City, Dong Nai Province.

Investor: Sonadezi Giang Dien Joint Stock Company

Scale: 529.2 ha

Starting time: 2008

Project operation time: until 2058

Overview of Giang Dien Industrial Park project

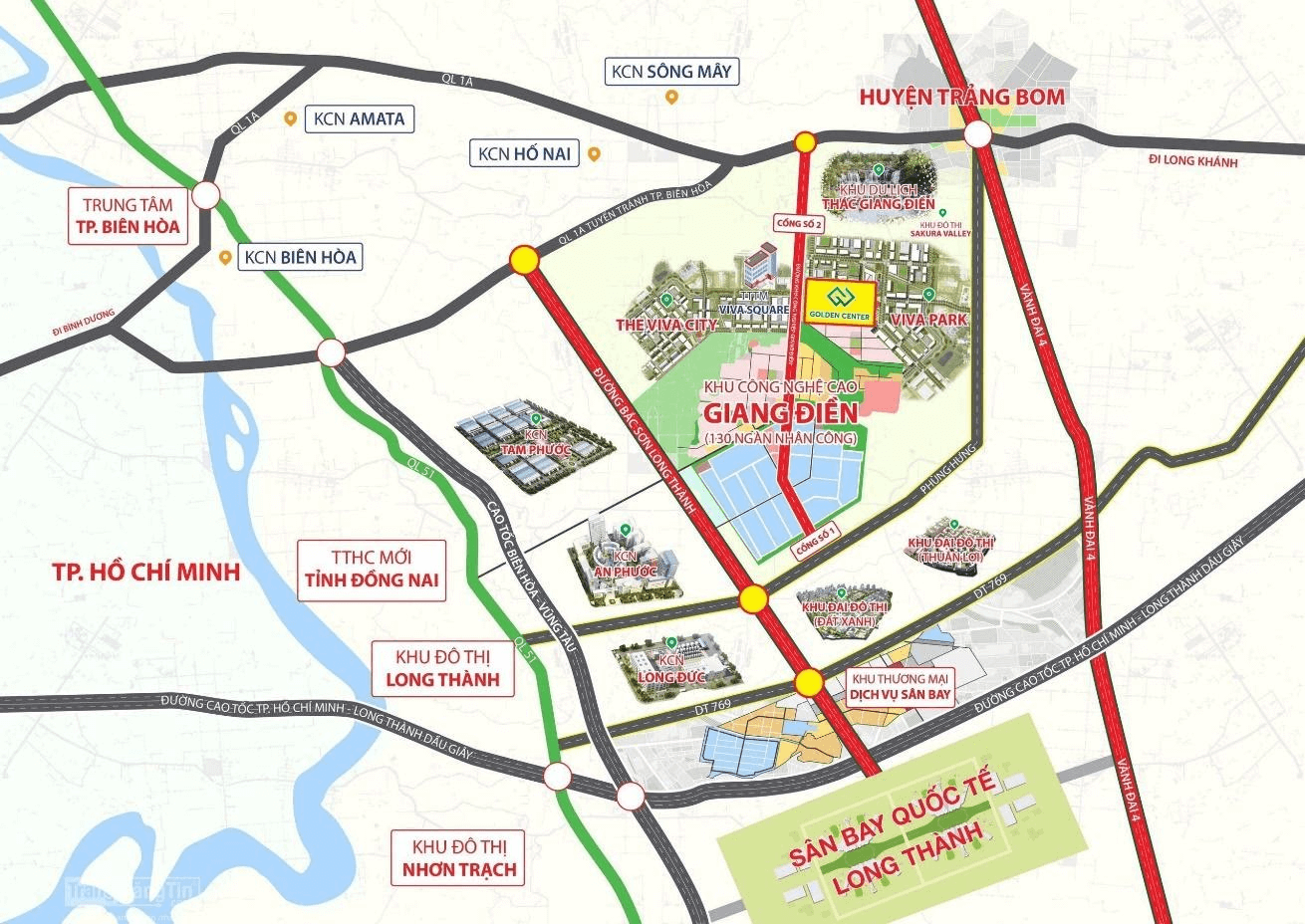

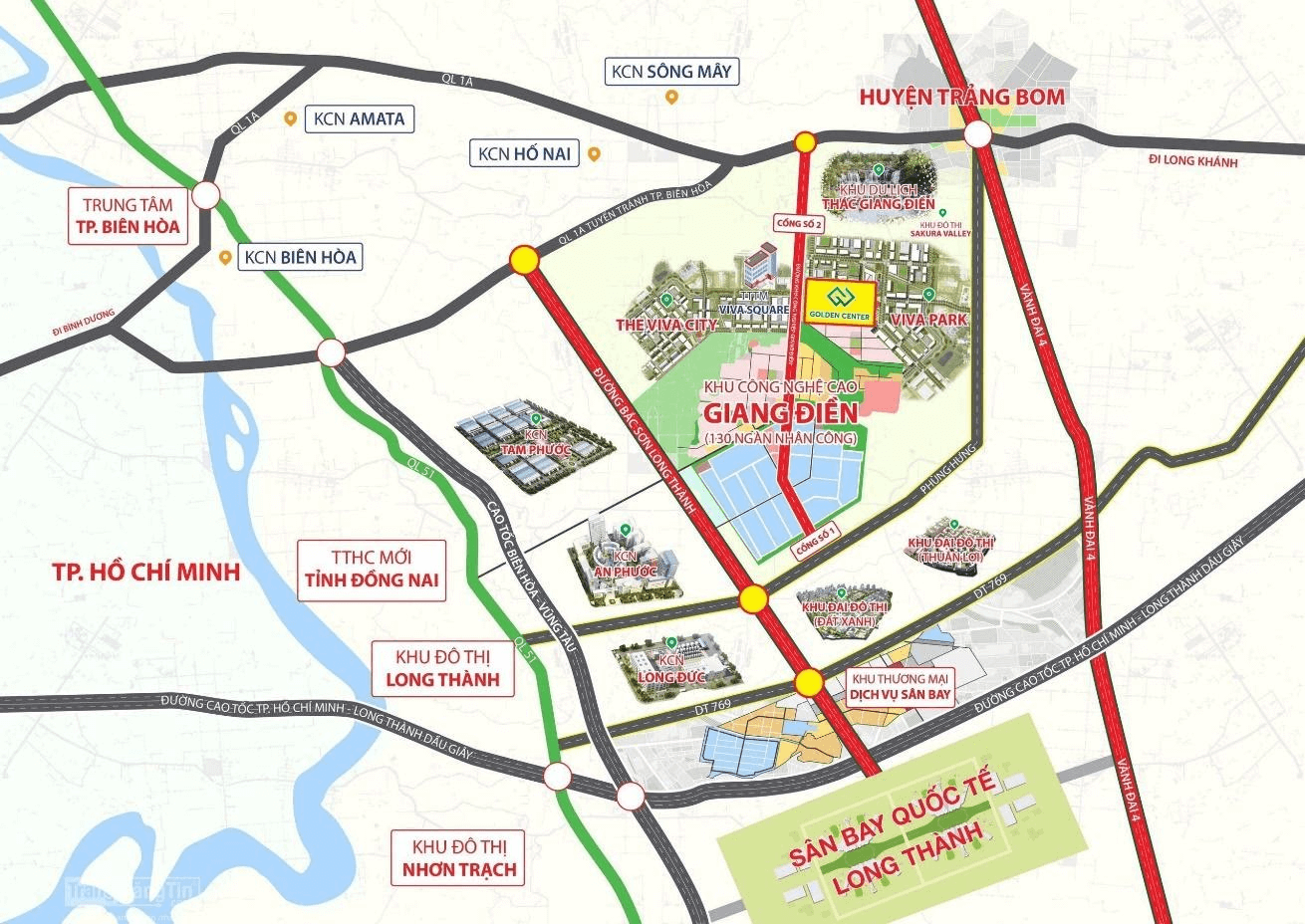

Location Giang Dien Industrial Park

Giang Dien industrial park located in Giang Dien commune, An Vien commune, Trang Bom district and Tam Phuoc commune, Bien Hoa city, Dong Nai province.

Located right next to Bien Hoa city and the gateway to Ho Chi Minh city. This place has become a “golden spot” attracting investment for many years.

Location Giang Dien Industrial Park

Distance to Residential Area and City Center:

Residential Area and Giang Dien Waterfall Eco-tourism Area: 01 km.

Bien Hoa City Center: 20 km.

Ho Chi Minh City Center: 44 km.

Distance to National Highways and Expressways:

National Highway 1A to the North: 4 km.

National Highway 51 to the West: 9 km, Bien Hoa – Vung Tau National Highway axis.

Ho Chi Minh City – Long Thanh – Dau Giay Expressway: 20 km

Distance to Ports, Water Port Clusters:

Cat Lai Port (HCMC): 43 km.

VICT Port (District 4, HCMC): 56km.

Go Dau Port: 36 km.

Phu My Deepwater Port (Tan Thanh – Ba Ria): 47km.

SP-PSA Port Cluster and SiTV Port (Tan Thanh – Ba Ria): 51 km

Cai Mep Port: 58 km.

Distance to International Airport:

Tan Son Nhat International Airport (HCMC): 49 km.

Long Thanh International Airport to the South: 22 km.

Infrastructure of Giang Dien Industrial Park

Internal traffic: synchronous, modern, wide road divided into 2-6 lanes. Along the roads are green trees and high-quality high-pressure lights.

Giang Dien Industrial Park Traffic Infrastructure

Power Supply System

– Electricity is supplied from the national grid from the Song May high-voltage reduction station on the 110kV line and the 110/22kV transformer station.

Water Supply System

Capacity: 15,000 m2/day and night (phase 1: 5,000 m2/day and night).

Communication System

Support for the installation of telecommunication services: IDD phone, FAX, ADSL, VoIP… Telephone lines and internet are installed according to the investor’s requirements.

Wastewater Treatment System

Centralized wastewater treatment plant with maximum capacity: 12,000 m2/day (Phase 1: 3,000 m2/day).

Wastewater to be treated: domestic wastewater and production wastewater.

The wastewater treatment fee can be adjusted to increase depending on the concentration of substances in the wastewater.

The volume of wastewater charged is 80% of the volume of water supplied.

Discharge standards from Industrial Park: QCVN 24:2009/BTNMT.

Giang Dien Industrial Park Wastewater Treatment Plant

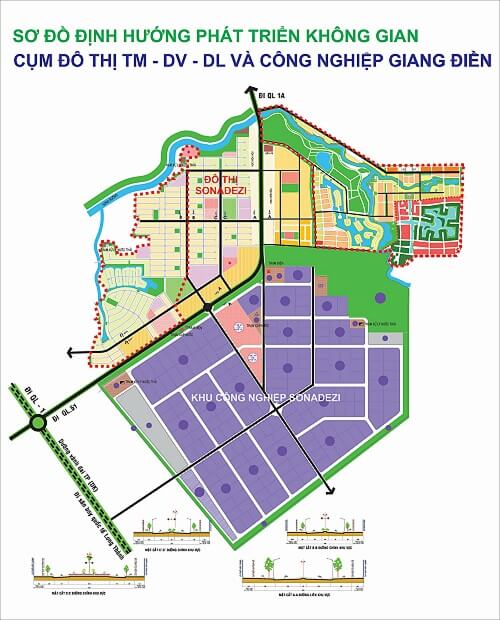

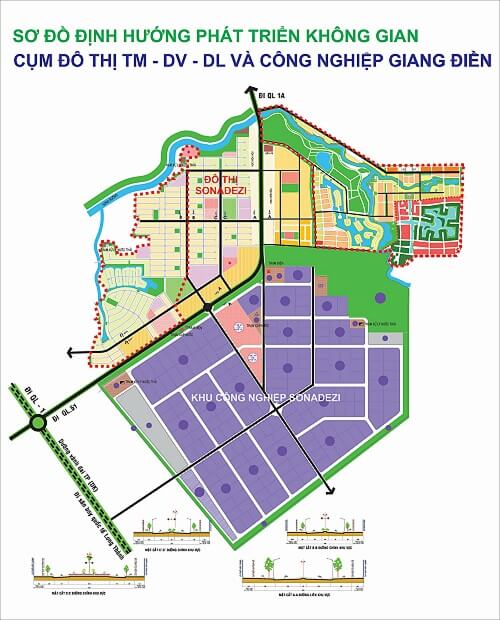

Current status of land use planning in Giang Dien Industrial Park

Total area: 529.2 ha

Total land area for lease: 322.8 ha

Occupancy rate (by 2020): over 70%

Giang Dien Industrial Park planning map

Priority areas for investment attraction

Manufacturing and producing high-tech products in telecommunications and information technology

Manufacturing and producing high-tech products in automation, mechatronics and precision mechanics

Manufacturing and producing new, high-tech products in the field of materials

Manufacturing and producing biotechnology products

Manufacturing and assembling electrical, electronic, digital equipment, audiovisual equipment

Manufacturing electric wires and cables

Manufacturing and assembling vehicles and spare parts for all types of cars, motorbikes, bicycles

Manufacturing and assembling all types of transmission engines, spare parts, control devices for the aviation and maritime industries

Manufacturing and processing mechanics

Manufacturing metal products, machinery, equipment, office equipment

Manufacturing medical instruments, sports equipment, children’s toys, teaching equipment

Manufacturing jewelry, imitation jewelry

Manufacturing interior and exterior decoration products

Products High-quality wood

Industrial products from plastic, rubber, glass

Production of pharmaceuticals, agricultural chemicals

Services providing food and drink for aircraft

Service industries serving production in industrial parks

Other less polluting manufacturing industries

Investment incentives policy

Corporate Income Tax (CIT) (Circular No. 78/2014/TT-BTC):

Tax rate: 20% for 10 years from the first year the project generates revenue, applicable to enterprises operating in industrial zones established under Government regulations (Article 15, Decree No. 218/2013/ND-CP and Appendix II, Decree No. 118/2015/ND-CP).

Incentives on Corporate Income Tax for enterprises operating in industrial zones: 100% tax exemption for the first 2 years and 50% reduction for the next 4 years (Clause 3, Article 20 of Circular No. 78/2014/TT-BTC and Decree No. 12/2015/ND-CP).

The tax rate of 10% applies for a period of 15 years (Article 19, Circular 78/2014/TT BTC) to newly established enterprises from investment projects in the following fields:

Software product production;

High technology according to the provisions of law; scientific research and technological development;

Production of industrial products supporting priority development.

Incentives on corporate income tax for enterprises operating in the above fields: 100% tax exemption for the first 4 years and 50% reduction for the next 9 years.

Incentives on tax exemption and reduction period: Calculated continuously from the first year the enterprise has taxable income from the new investment project enjoying tax incentives. In case an enterprise has no taxable income in the first three years, from the first year of revenue from a new investment project, the tax exemption or reduction period is calculated from the fourth year the new investment project generates revenue (Clause 4, Article 20 of Circular No. 78/2014/TT-BTC).

Export tax, import tax:

Import tax rate: 0% for goods that are machinery, equipment, specialized vehicles used to create fixed assets; raw materials, supplies for the production of export goods; construction materials that cannot be produced domestically.

Export tax rate: 0% for goods that are products manufactured for export.

Tax on Remittances:

Complete exemption from tax on remittances.

Value Added Tax (VAT):

- Value Added Tax applies to goods and services consumed in Vietnam and is collected through production, trade and service distribution at rates of 0%, 5% and 10%.

- A rate of 0% applies to the export of goods and certain services, including goods and services supplied to industrial zones.

Giang Dien Industrial Park Project Planning Map

Download high quality file of industrial park planning map: Link

Review of Giang Dien Industrial Park

The industrial park is located in the largest industrial area of Dong Nai province, near 03 densely populated areas: Bien Hoa city, Long Thanh district and Trang Bom.

This is one of three industrial parks in Dong Nai province planned for projects in the supporting industry sector.

Conveniently connected to main traffic routes: National Highway 1A, National Highway 51, Vo Nguyen Giap Road (Bien Hoa City bypass), Ho Chi Minh City – Long Thanh – Dau Giay Expressway.

Industrial land and factory products with diverse and flexible areas meet the needs of investors.

Support investors in carrying out legal procedures to apply for Investment Registration Certificates and Business Registration Certificates.

Internal support services are gradually being improved to serve the needs of investors and workers in the industrial park.

Services of Vietnam Property Hub

- Investment promotion (land, factories) in industrial parks, industrial clusters and commercial service land, …

- Legal support & Investment consulting in areas related to industrial real estate.

- Connecting and cooperating in industrial real estate investment.

Contact consultant

江田工业园区项目概况

Giang Dien industrial park 江田工业园区是20世纪初同奈省南部重点工业园区项目之一。

该园区于2008年开工建设,总占地面积529公顷。江田工业园区是同奈省规划的两个工业园区之一,旨在为该地区的配套产业项目提供支持。

项目名称:Giang Dien industrial park

地点:同奈省边和市庄奔县江田乡、安园乡和三福乡。

投资方:Sonadezi 江田股份公司

规模:529.2 公顷

开工时间:2008 年

项目运营期限:至 2058 年

江田工业园区项目概况

位置 江田工业园区

江田工业园区位于同奈省边和市庄奔县安远乡江田乡和三福乡。

紧邻边和市,是通往胡志明市的门户。多年来,这里一直是吸引投资的“黄金地段”。

位置 江田工业园区

距住宅区和市中心的距离:

距住宅区和江田瀑布生态旅游区:0.1公里。

距边和市中心:20公里。

距胡志明市中心:44公里。

距国道和高速公路的距离:

北距1A国道:4公里。

西距51国道:9公里,以边和-头顿国道为轴线。

胡志明市-隆城-油桥高速公路:20公里。

距港口、水港群的距离:

吉莱港(胡志明市):43公里。

VICT港(胡志明市第四郡):56公里。

Go Dau港:36公里。

富美深水港(新城-巴地):47公里。

SP-PSA 港口群及 SiTV 港口(新城 – 巴地):51 公里

盖梅港:58 公里

距国际机场:

新山一国际机场(胡志明市):49 公里

南距隆城国际机场:22 公里

江田工业园区基础设施

内部交通:同步、现代化、宽阔的道路,分为2-6车道。道路两旁绿树成荫,配有高品质的高压路灯。

江田工业园区交通基础设施

供电系统

– 电力由国家电网供应,由110千伏线路上的宋梅高压减压站和110/22千伏变电站供电。

供水系统

供水能力:15,000平方米/昼夜(一期:5,000平方米/昼夜)。

通讯系统

支持安装电信服务:国际直拨电话、传真、ADSL、VoIP……电话线路和互联网可根据投资者需求安装。

污水处理系统

集中式污水处理厂,最大处理能力:12,000平方米/日(一期:3,000平方米/日)。

处理废水:生活污水和生产废水。

污水处理费可根据废水中物质的浓度进行调整。

污水处理费为供水量的80%。

工业园区排放标准:QCVN 24:2009/BTNMT。

江田工业园区污水处理厂

江田工业园区土地利用规划现状

总面积:529.2公顷

可出租土地总面积:322.8公顷

入住率(2020年):超过70%

江田工业园区规划图

招商引资重点领域

电信和信息技术领域高科技产品的制造和生产

自动化、机电一体化和精密机械技术领域高科技产品的制造和生产

材料领域高新技术产品的制造和生产

生物技术产品的制造和生产

电气、电子、数字设备和视听设备的制造和组装

电线电缆制造

各类汽车、摩托车、自行车及车辆零配件的制造和组装

各类航空和航海传动、发动机、零配件和控制装置的制造和组装

机械制造和加工

金属制品、机械设备、办公设备制造

医疗器械、运动器材、儿童玩具、教学设备制造

珠宝首饰、仿制珠宝首饰制造

室内外装饰产品制造

优质木材产品

塑料、橡胶工业制品玻璃

药品、农用化学品生产

飞机食品饮料供应服务

为工业园区生产提供服务的行业

其他低污染制造业

投资激励政策

企业所得税(CIT)(第78/2014/TT-BTC号通知):

税率:自项目产生收入的第一年起,10年内适用20%的税率,适用于根据政府规定设立的工业园区内企业(第218/2013/ND-CP号法令第15条及第118/2015/ND-CP号法令附录二)。

工业园区内企业的企业所得税优惠:前两年免税,后四年减半(第78/2014/TT-BTC号通知第20条第3款及第12/2015/ND-CP号法令)。

10%的税率适用于以下领域投资项目新设立的企业,有效期为15年(第78/2014/TT BTC号通知第19条):

软件产品生产;

依法规定的高科技产品;科学研究与技术开发;

支持优先发展的工业产品生产。

上述领域企业的企业所得税优惠:前4年100%免税,后9年减半。

减免税优惠期限:自企业享受税收优惠的新投资项目获得应税收入的第一年起连续计算。企业自新投资项目产生收入第一年起三年无应税收入的,免税、减税期自新投资项目产生收入第四年起计算(第78/2014/TT-BTC号通知第20条第4款)。

出口税、进口税:

进口税率:用于制造固定资产的机械、设备、专用车辆;用于生产出口产品的原材料、物资;国内无法生产的建筑材料。

出口税率:用于出口的制造产品。

汇款税:

汇款完全免税。

增值税 (VAT):

增值税适用于在越南消费的商品和服务,通过生产、贸易和服务分销征收,税率分别为 0%、5% 和 10%。

出口商品和某些服务(包括供应给工业区的商品和服务)适用 0% 的税率。

江田工业园区项目规划图

下载工业园区规划图高清文件: Link

江田工业园区回顾

该工业园区位于同奈省最大的工业区,毗邻三个人口稠密的地区:边和市、隆城县和庄奔县。

该工业园区是同奈省规划建设的三个工业园区之一,主要面向辅助工业领域项目。

交通便利,毗邻主要交通干线:1A国道、51国道、武元甲路(边和市绕城公路)、胡志明市-隆城-油桥高速公路。

工业用地和厂房产品种类多样,布局灵活,可满足投资者的需求。

协助投资者办理投资登记证和营业登记证的合法手续。

园区内部配套服务正在逐步完善,以满足工业园区投资者和工人的需求。

越南房地产中心的服务

- 工业园区、产业集群和商业服务用地的招商引资(土地、工厂)……

- 工业地产相关领域的法律支持和投资咨询。

- 工业地产投资对接与合作。

联系顾问

Consultant 5 years experience