[Long An] IDICO Thu Thua Industrial Park

June 16, 2025Overview of Thu Thua Industrial Park project

Thu Thua Idico industrial parkConstruction began in mid-2019, with a scale of 188 hectares right in the center of Thu Thua district. The industrial park focuses on many industries, focusing on attracting FDI capital. triển khai xây dựng vào giữa năm 2019, với quy mô 188 ha ngay trung tâm huyện Thủ Thừa. Khu công nghiệp tập trung đa ngành nghề, chú trọng thu hút vốn đầu tư FDI.

Immediately after starting construction, the industrial park project quickly received the attention of many domestic and foreign enterprises/investors. Along with the advantages of the industrial zone, IDICO Thu Thua Industrial Park is also facing many great opportunities from the wave of relocation in the region.

Project name: Khu công nghiệp IDICO Thủ Thừa

Location: Quarter 11, Thu Thua Town, Thu Thua District, Long An Province, Vietnam

Investor: Thu Thua Industrial Park and Urban Development Joint Stock Company IDICO-CONAC

Scale: 188.88 ha

Starting time: 2019

Project operation time: until 2069

Entrance gate to Thu Thua Industrial Park project

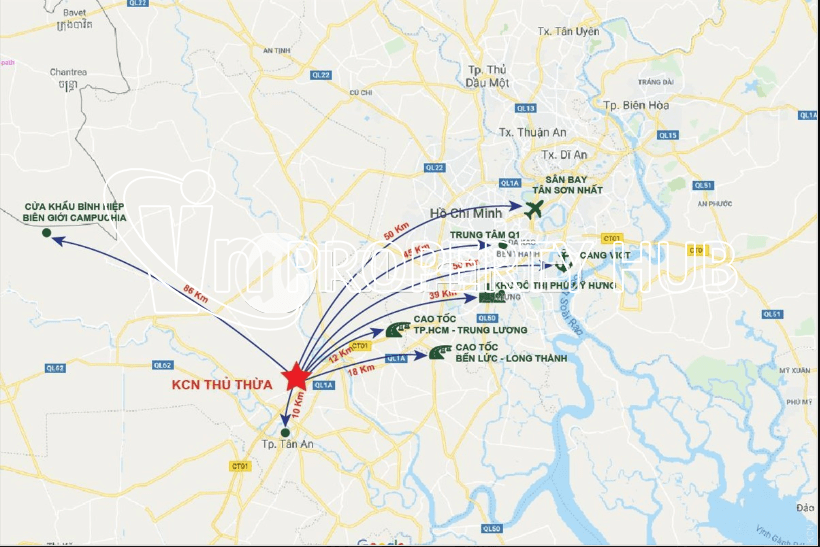

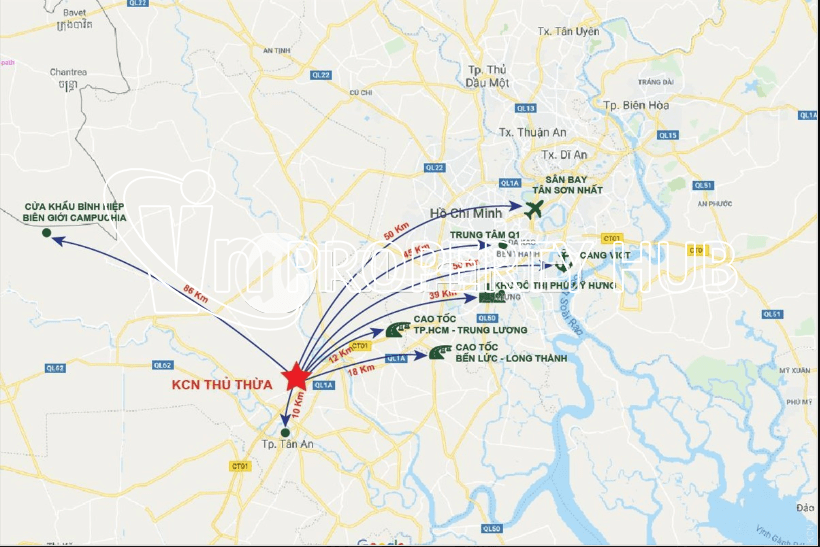

Location of Thu Thua Industrial Park

Thu Thua Industrial Park located in Hamlet 11, Thu Thua Town, Thu Thua District, Long An Province.

- North: Adjacent to Muong Khai Canal

- South: Adjacent to residential area and industrial park resettlement area

- East: Adjacent to Bo Bo Canal

- West: Adjacent to Ba Bang Canal

Location of Thu Thua Industrial Park

Built at the junction of many key traffic routes and considered the gateway for trade between the key economic region of the South and the provinces of the Mekong Delta, IDICO Thu Thua Industrial Park has many prospects in local and regional connections.

Road distance:

Tan An City: 10 Km

Phu My Hung Urban Area: 35 Km

Ho Chi Minh City Center: 40 Km

Binh Hiep Border Gate (Cambodia Border): 80 Km

Distance to the port:

VICT Long An Port: 45 Km

Bourbon Ben Luc Long An Port: 15 Km

Distance to the airport:

Tan Son Nhat Airport – Ho Chi Minh City: 45 Km

Long Thanh Airport (future): 80 Km

Infrastructure of IDICO Thu Thua Industrial Park

Water supply:

Water source is taken from Binh Anh water supply plant, Thu Thua district (current capacity is 15,000 m3/day), or exploiting surface water source at clean water supply plant with capacity of 5,000 m3/day and night which will be invested in construction in Thu Thua Industrial Park, Thu Thua district, Long An province.

Power supply:

In the first phase, use power from 110/22kV station – (2×63) in Hoa Binh industrial park; in the long term, build a transformer station in the industrial park with a land area of 1.02 ha.

Traffic:

- External traffic: Provincial road 818 to National Highway 1A has a road width of 40m, road surface width of 18m, sidewalks on both sides are 11mx2 wide. The red line from the center of the road in is 20m;

- Internal traffic: Internal traffic infrastructure has a road width of 31m÷41m, meeting the standards for large-tonnage vehicles; has lighting system, trees;

- Waterway traffic: Arrange an inland waterway wharf with an area of about 1.02ha to serve freight transport through Bo Bo canal connecting to Thu Thua canal to reach Vam Co Dong river and Vam Co Tay river;

Communication:

- The communication system from Thu Thua town telecommunications station, provided by network operators such as: VNPT, FPT, Viettel… ensures smooth domestic and international communication; includes full services: telephone, Fax, Internet…

Drainage:

- The rainwater drainage system is built separately from the wastewater drainage system, fully invested to receive at the foot of the factory fence and flow into rivers and canals suitable for the terrain of each land plot;

- Drainage direction to the canals around the project (Bo Bo canal, Ranh canal, Ba Bang canal);

- The drainage system uses reinforced concrete culverts D800÷D2.500. Manholes are arranged at suitable locations to collect water.

Wastewater treatment:

- The wastewater drainage system from the industrial park will be designed separately, completely independent from the rainwater drainage system and receive wastewater at the foot of the factory fence;

- The wastewater system of the industrial park is centrally treated at the wastewater treatment plant located next to D1 road. After passing through the treatment plant and ensuring drainage standards, the wastewater will flow through the biological pond before being discharged into Ba Bang canal.

- The centralized wastewater treatment system has a total treatment capacity of 8,000 m3/day and night.

Thu Thua Industrial Park Project Management Board Building

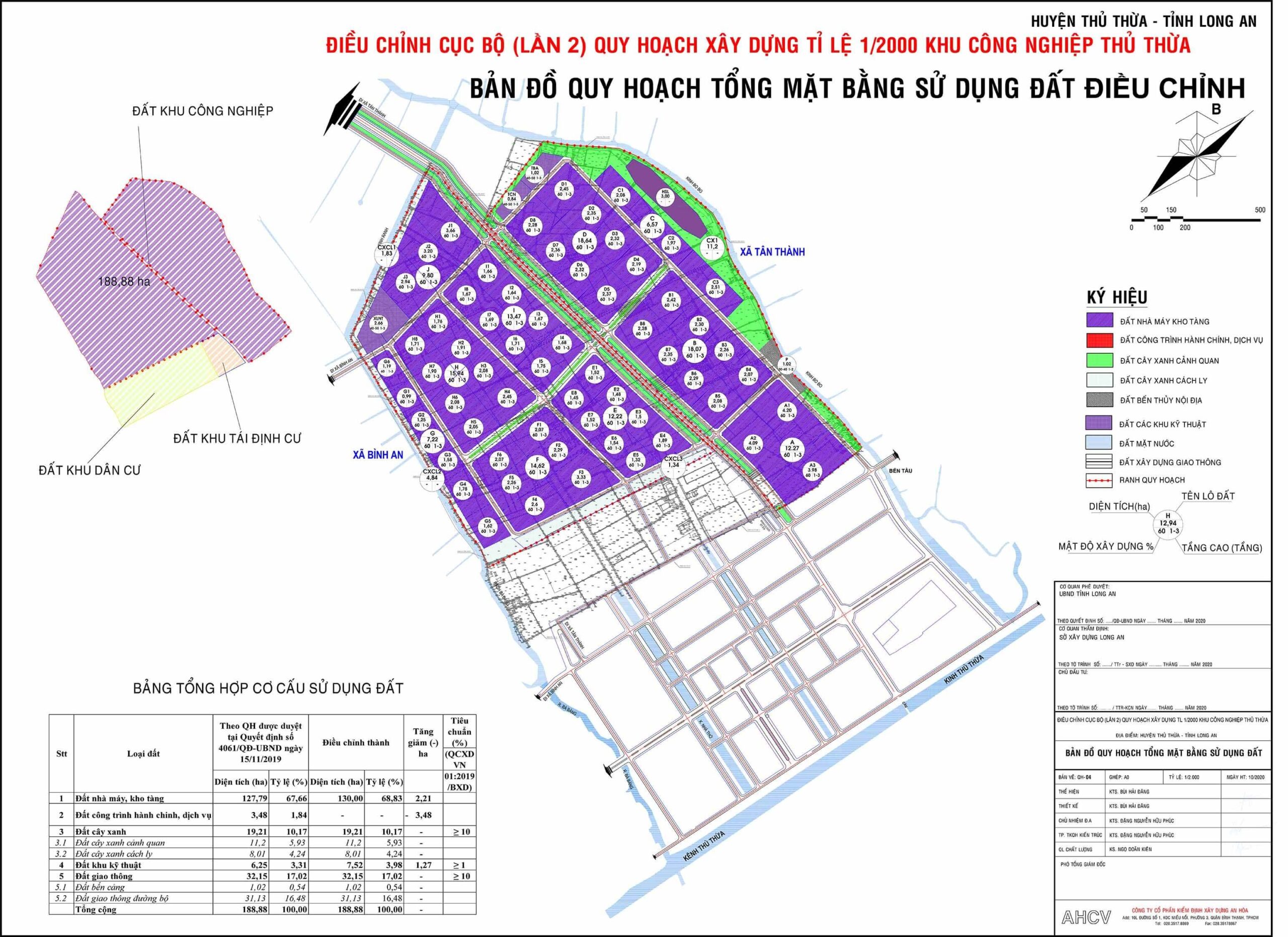

Current status of land use planning of IDICO Thu Thua Industrial Park

- Total area: 188.88 ha

- Industrial land area for lease: 130.00 ha

- Industrial park operation period: From the date of signing the land lease contract until 2069. Start handing over clean land to investors in the fourth quarter of 2021.

- Construction investment situation: Implementing compensation for site clearance, constructing technical infrastructure of the industrial park in parallel with attracting investment.

Planning map of Thu Thua Industrial Park project

Priority areas for investment attraction

– Dyeing, bleaching, printing projects to complete textile products; electroplating to complete mechanical products;

– Projects to produce fertilizers, detergents, dyes, paints, printing inks;

– High-tech manufacturing projects: electrical and electronic equipment; electrical and electronic components; telecommunication cables;

– Mechanical projects (no casting, smelting): manufacturing machinery and equipment; manufacturing, assembling, repairing motorbikes;

– Food and beverage processing projects;

– Pharmaceutical and cosmetic production projects;

– Household plastic production projects, plastic packaging (from plastic beads);

– Interior decoration equipment production projects;

– Garment projects (no washing, bleaching, dyeing stages);

– Projects to support agricultural development: processing, preserving agricultural, forestry and aquatic products, handling and processing raw materials for rural production, production of wooden furniture, rattan and bamboo weaving, ceramics, glass, textiles, yarn, embroidery, knitting, small mechanics, production and trading of ornamental plants, salt production, services for production and rural residents’ lives);

– Projects to process aquatic products from fresh raw materials through preliminary processing, production of fish sauce on an industrial scale, production of animal fat, vegetable oil;

– Projects to produce alcohol, wine, beer;

– Projects to produce animal feed, poultry, aquatic products from preliminary processing raw materials;

– Production of sugar, monosodium glutamate.

– And some other industries that do not cause serious pollution and toxicity…

Investment incentives

Corporate income tax

Tax rate: Corporate income tax applied from January 1, 2016 is 20%.

Tax exemption and reduction:

Enterprises are exempted from tax for 2 years and have 50% of the tax payable reduced in the next 4 years (Based on Article 6 of Circular No. 151/2014/TT-BTC dated October 10, 2014).

Enterprises are exempted from tax for 4 years and have 50% of the tax payable reduced in 9 years for projects in the fields of special investment incentives as prescribed in Decree 118/2015/ND-CP dated January 12, 2015.

Conditions for enjoying incentives: New investment projects as prescribed in Clause 3, Article 10 of Circular 96/2015/TT-BTC dated June 22, 2015. Regulations on tax exemption and reduction period: The tax exemption and reduction period is calculated continuously from the first year the enterprise has taxable income from the new investment project enjoying tax incentives. In case the enterprise has no taxable income in the first three years, from the first year of revenue from the new investment project, the tax exemption and reduction period is calculated from the fourth year the new investment project generates revenue. (Based on Clause 2, Article 12 of Circular 96/2015/TT-BTC dated June 22, 2015).

Non-agricultural land tax:

0.03% of non-agricultural land price issued with Decision No. 74/2019/QD-UBND dated December 31, 2019 of Long An province, and reduced by 50%.

Other incentives

Import tax exemption for imported goods according to the provisions of Article 12, Decree No. 87/2010/ND-CP dated August 13, 2010.

Project planning map

Download high quality file of industrial park planning map: Link

Evaluation of Thu Thua Industrial Park project

Thu Thua Industrial Park possesses many strengths to attract investment such as:

- Ideal traffic connectivity thanks to its gateway location

- Synchronous infrastructure planning in terms of architecture and infrastructure

- Professional Logistic service system effectively supports businesses

- Inland ports create convenience for investors in transporting goods from industrial parks to domestic and foreign ports

- Competitive industrial park land rental prices, investors are applying many incentives

- Businesses are fully supported with investment legal procedures

- Diverse, high-quality, modern utility system both inside and outside the project

IDICO Thu Thua Industrial Park, together with Viet Phat Industrial Park (1,800ha in size), will be deployed at the end of 2019, and will be two key projects of Thu Thua district in the period of 2020 – 2025.

Not only does it have a great impact on the economy of Thu Thua district, creating momentum for the development of industrial parks in the future, and solving local employment, but IDICO Thu Thua Industrial Park is also a project that has a great impact on Thu Thua real estate, and is also one of the “focuses” attracting foreign investment capital in Long An province.

Services of Vietnam Property Hub

- Investment promotion (land, factories) in industrial parks, industrial clusters and commercial service land, …

- Legal support & Investment consulting in areas related to industrial real estate.

- Connecting and cooperating in industrial real estate investment.

Contact consultant

守承工业园区项目概况

守承工业园区(Thu Thua Idico Industrial Park)于2019年中期开工建设,占地188公顷,位于守承县中心地带。该工业园区重点发展多个产业,并致力于吸引外商直接投资(FDI)。

该工业园区项目开工后,迅速吸引了众多国内外企业/投资者的关注。除了工业园区的优势外,IDICO守承工业园区也面临着区域搬迁浪潮带来的诸多机遇。

项目名称:IDICO守承工业园区

地点:越南隆安省守承县守承镇第11区

投资方:守承工业园区和城市发展股份公司IDICO-CONAC

规模:188.88公顷

开工时间:2019年

项目运营时间:至2069年

Entrance gate to Thu Thua Industrial Park project

守承工业园区位置

守承工业园区位于隆安省守承县守承镇第11村。

- 北:毗邻芒开运河

- 南:毗邻住宅区和工业园区安置区

- 东:毗邻波波运河

- 西:毗邻巴邦运河

守承工业园区位置

IDICO Thu Thua 工业园区建在许多主要交通路线的交汇处,被视为南部主要经济区与湄公河三角洲省份之间的贸易门户,在当地和区域连接方面具有广阔的前景。

公路距离:

新安市:10 公里

富美兴市区:35 公里

胡志明市中心:40 公里

平协边境口岸(柬埔寨边境):80 公里

距离港口:

隆安港:45 公里

隆安港:15 公里

距离机场:

新山一机场 – 胡志明市:45 公里

隆城机场(规划中):80 公里

IDICO Thu Thua工业园区基础设施

供水:

水源取自位于守承县的平英供水厂(目前供水能力为15,000立方米/日),或利用位于隆安省守承县守承工业园区内,日供水能力为5,000立方米/夜的清水厂的地表水。

供电:

一期工程使用位于和平工业园区的110/22千伏(2×63)变电站的电力;远期工程将在工业园区内建设一座占地1.02公顷的变电站。

交通:

外部交通:818省道至1A国道,道路宽度40米,路面宽度18米,两侧人行道宽度为11米x2米。道路中心向内红线20米;

内部交通:内部交通基础设施:道路宽度31米÷41米,符合大吨位车辆通行标准;设有照明系统和绿化;

水路交通:规划建设约1.02公顷的内河码头,用于货物运输,经博博运河连接守承运河,可到达万古东河和万古西河;

通讯:

守承镇电信站的通讯系统由VNPT、FPT、Viettel等网络运营商提供,确保国内外通讯畅通;提供全套服务:电话、传真、互联网……

排水:

雨水排水系统与废水排水系统分开建设,全额投资,收集厂区围栏底部的雨水,并根据各地块的地形,将其排入河流和水渠;

排水方向为项目周围的水渠(Bo Bo水渠、Ranh水渠、Ba Bang水渠);

排水系统采用D800÷D2,500钢筋混凝土涵洞。在适当位置设置了人孔以收集积水。

废水处理:

- 工业园区的污水排放系统将单独设计,与雨水排放系统完全独立,并在工厂围墙脚下接收污水;

- 工业园区的污水系统在位于D1公路旁的污水处理厂集中处理。污水经处理厂处理后,在确保达标排放后,将流经生物塘,最终排入巴邦运河。

- 该集中污水处理系统的总处理能力为8000立方米/日/夜。

守承工业园区项目管理委员会大楼

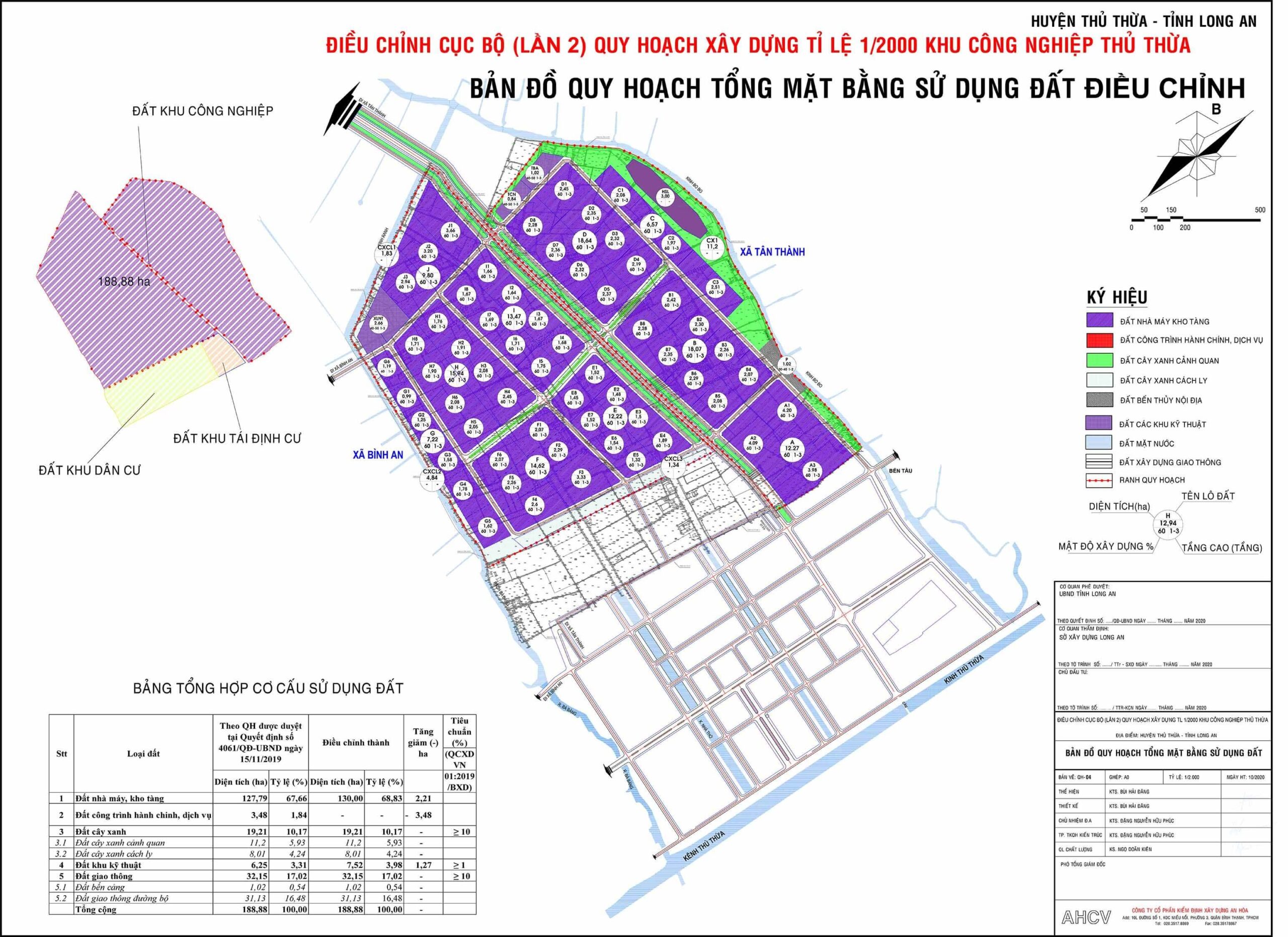

IDICO守承工业园区土地利用规划现状

- 总面积:188.88公顷

- 工业用地租赁面积:130.00公顷

- 工业园区运营期限:自签订土地租赁合同之日起至2069年。2021年第四季度开始向投资者交付干净土地。

- 建设投资情况:实施场地清理补偿,同步进行工业园区技术基础设施建设和招商引资。

守承工业园区项目规划图

招商引资重点领域

– 染色、漂白、印花项目,用于完成纺织品;电镀项目,用于完成机械产品;

– 生产肥料、洗涤剂、染料、涂料、印刷油墨的项目;

– 高科技制造项目:电气和电子设备;电气和电子元件;电信电缆;

– 机械项目(不含铸造、冶炼):制造机械设备;制造、组装、维修摩托车;

– 食品和饮料加工项目;

– 药品和化妆品生产项目;

– 家用塑料生产项目,塑料包装(由塑料珠制成);

– 室内装饰设备生产项目;

– 服装项目(不含洗涤、漂白、染色工序);

– 支持农业发展的项目:农林水产品加工及保鲜,农业生产原材料处理及加工,木制家具生产、藤竹编织、陶瓷、玻璃制品生产、纺织、纱线生产、刺绣、针织、小型机械制造、观赏植物生产及贸易、盐业生产、生产及农村生活服务等。

– 鲜活水产品初加工项目,工业规模鱼露生产,动物油脂、植物油生产;

– 酒精、葡萄酒、啤酒生产项目;

– 饲料、家禽养殖、水产品初加工项目;

– 糖、味精生产。

– 以及其他污染和毒性较小的行业……

投资优惠

企业所得税

税率:自2016年1月1日起,企业所得税税率为20%。

税收减免:

企业可享受2年免税,并可在未来4年内减免50%的应纳税额(根据2014年10月10日第151/2014/TT-BTC号通知第6条)。

企业根据2015年1月12日第118/2015/ND-CP号法令规定,属于特别投资优惠领域的项目,可享受4年免税、9年内减半缴纳企业所得税的优惠政策。

享受优惠条件:符合2015年6月22日第96/2015/TT-BTC号通知第10条第3款规定的新投资项目。减免税期限规定:减免税期限从企业享受优惠政策的新投资项目产生应税收入的第一年起连续计算。如果企业在前三年没有应税收入,则从新投资项目产生收入的第一年起,减免税期限从新投资项目产生收入的第四年起计算。 (根据2015年6月22日第96/2015/TT-BTC号通函第12条第2款)。

非农业土地税:

根据隆安省2019年12月31日第74/2019/QD-UBND号决定,非农业土地价格的0.03%,减半征收。

其他优惠政策

根据2010年8月13日第87/2010/ND-CP号法令第12条规定,进口货物免征进口税。

项目规划图

守承工业园区项目评估

Thu Thua Industrial Park 拥有吸引投资的诸多优势,例如:

- 地理位置优越,交通便利

- 建筑与基础设施同步规划

- 专业的物流服务体系有效支持企业发展

- 内陆港口为投资者提供便捷的货物从工业园区运输至国内外港口

- 工业园区土地租赁价格极具竞争力,投资者可享受多项优惠政策

- 企业在投资法律程序方面获得全方位支持

- 项目内外拥有多元化、高品质、现代化的公共设施系统

IDICO守承工业园区与占地1800公顷的越发工业园区将于2019年底投入使用,并将成为2020年至2025年守承县的两大重点项目。

IDICO守承工业园区不仅对守承县的经济产生巨大影响,为未来工业园区的发展创造动力,解决当地就业,而且对守承县的房地产业也具有重大影响,是隆安省吸引外资的“重点”之一。

越南房地产中心的服务

- 工业园区、产业集群和商业服务用地的招商引资(土地、工厂)……

- 工业地产相关领域的法律支持和投资咨询。

- 工业地产投资对接与合作。

联系顾问

Consultant 5 years experience