Vietnam Industrial Real Estate Market Quarter I/2021

May 15, 2025Key outlooks for the industrial real estate market and opportunities for Vietnam:

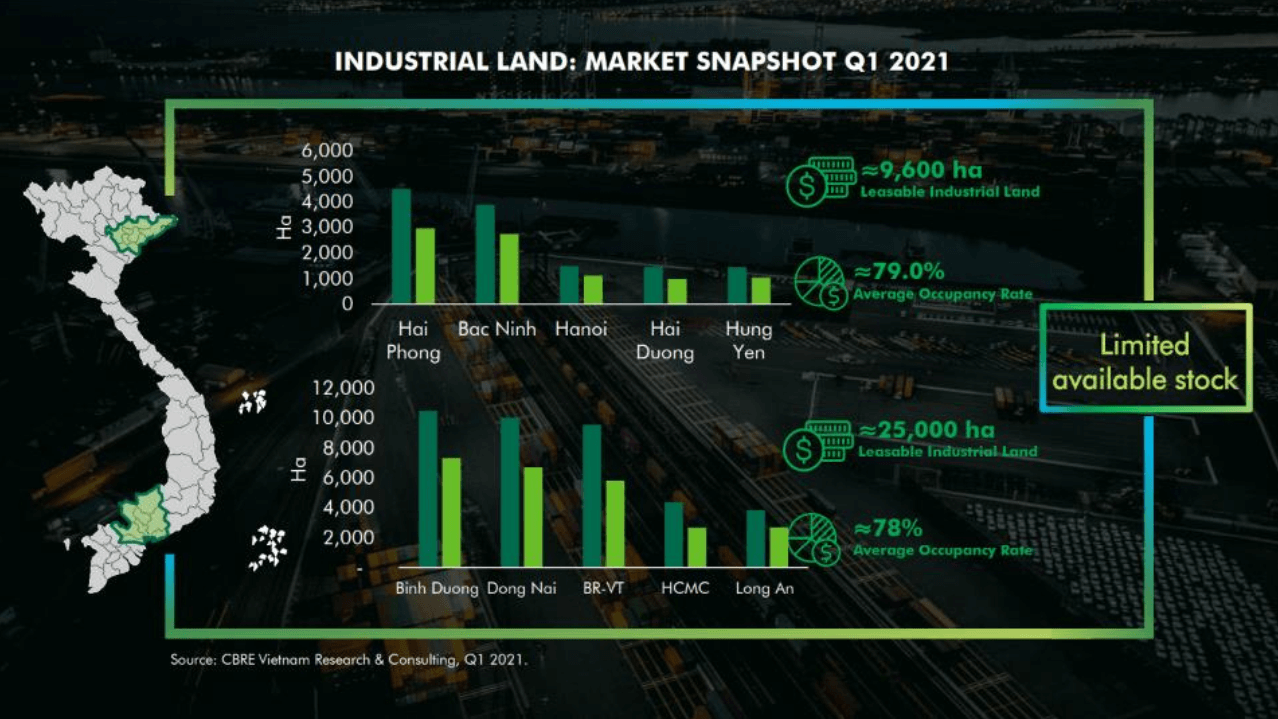

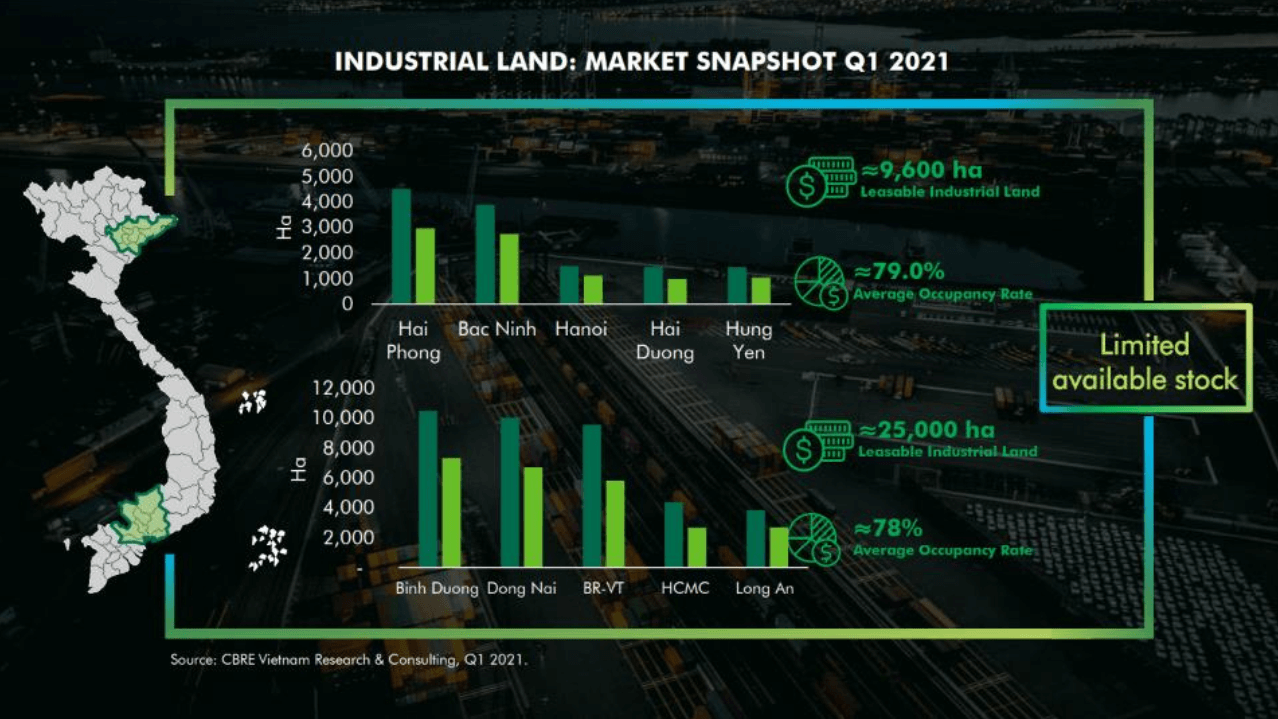

The available industrial real estate land fund for lease in the North and South is still limited, accounting for 20%.

Northern region:

Industrial real estate land fund for lease: 9,600ha

Occupancy rate: 79%

Southern region:

Industrial real estate land fund for lease: 25,000ha

Occupancy rate: 78%

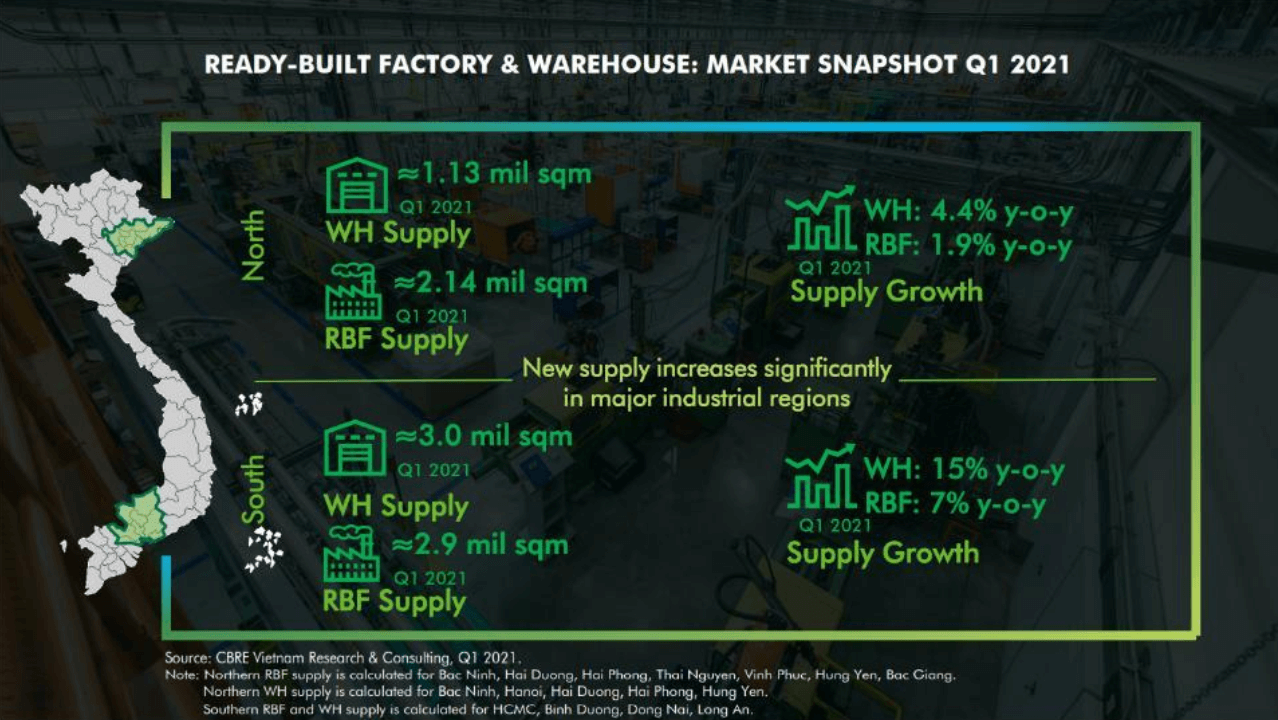

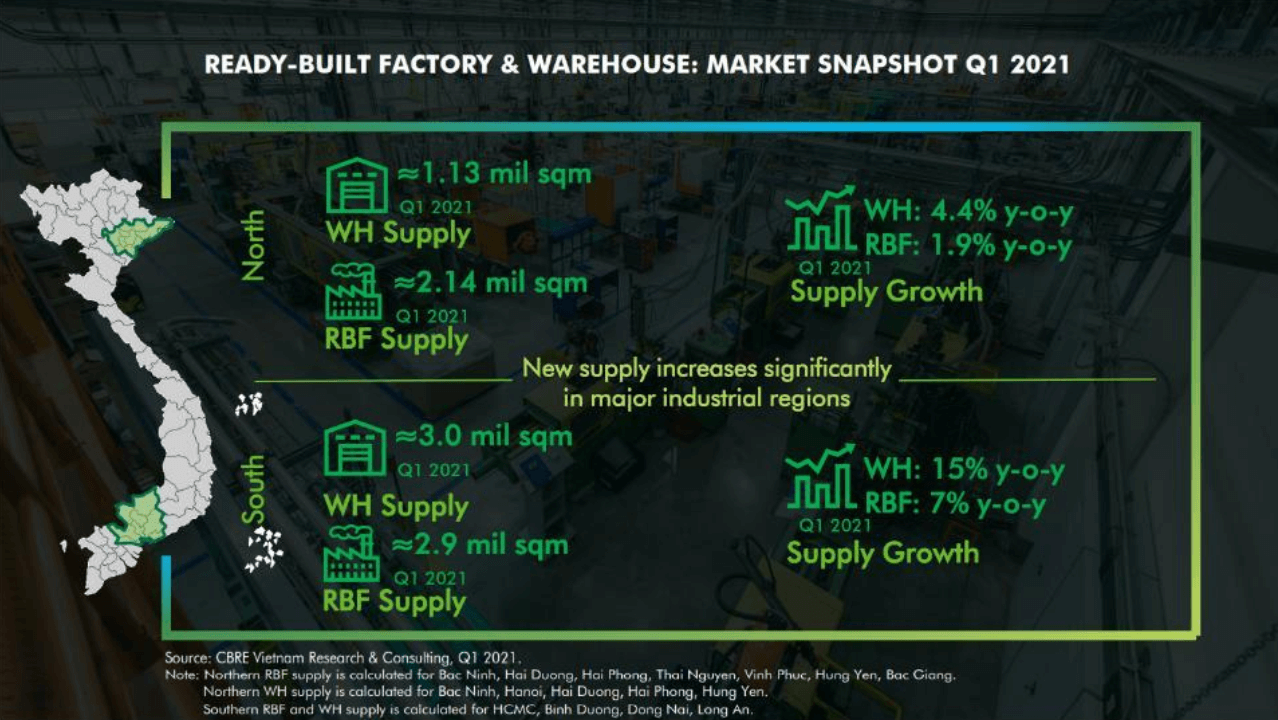

Supply of warehouses and ready-built factories increased significantly compared to the same period last year, mostly concentrated in industrial parks.

Northern region:

Warehouse supply reached 1.13 million m2; up 4.4% compared to the same period last year.

Pre-built factory supply reached 2.14 million m2; up 1.9% compared to the same period last year.

Southern region:

Warehouse supply reached 3 million m2; up 15% compared to the same period last year.

Pre-built factory supply reached 2.9 million m2; up 7% compared to the same period last year.

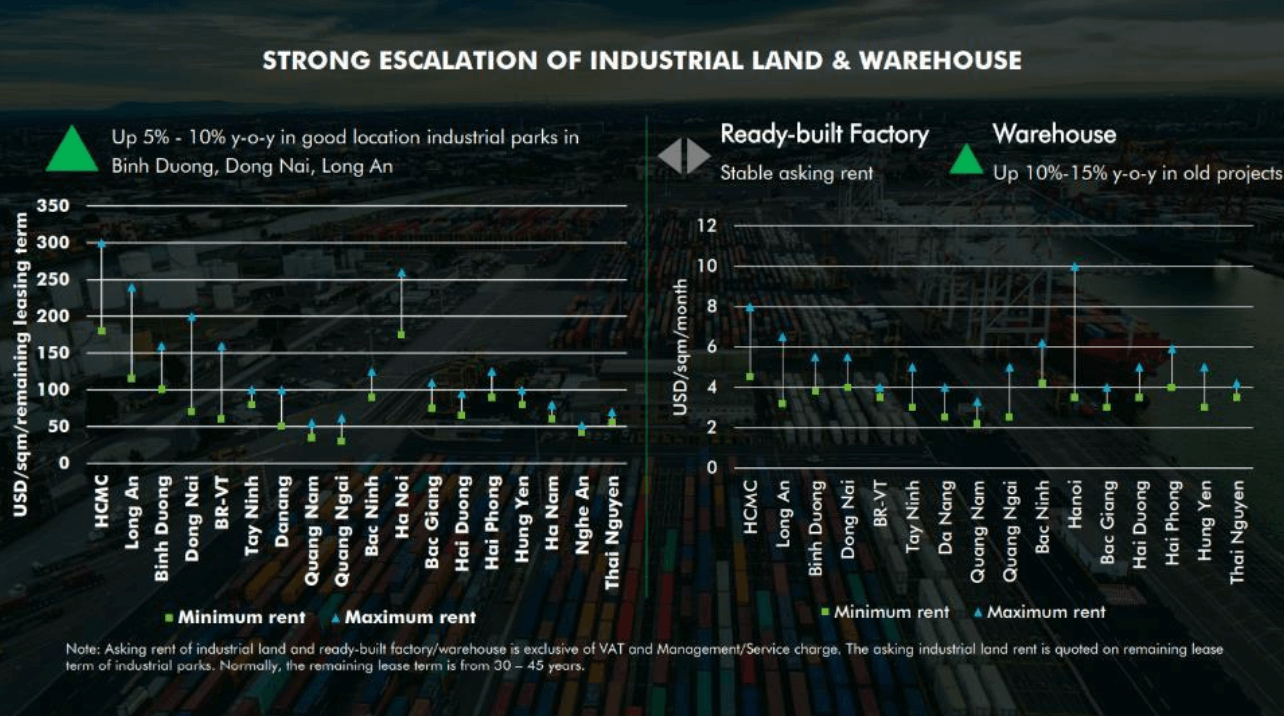

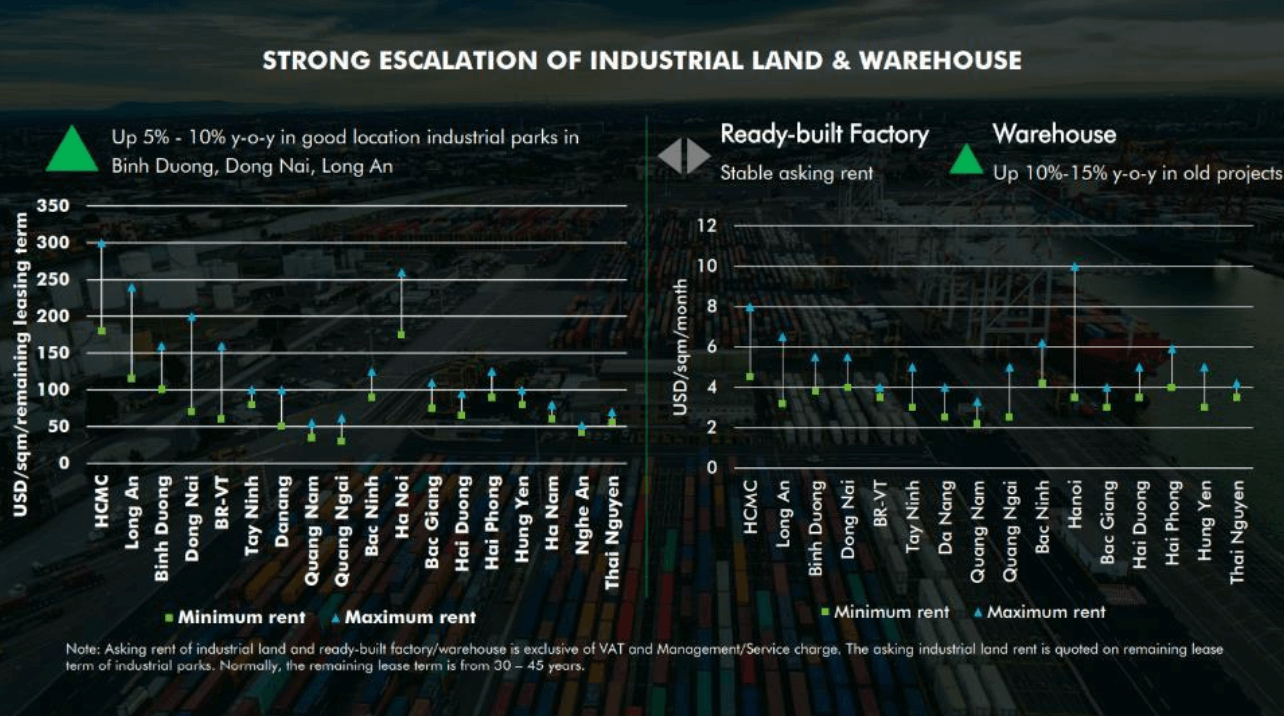

Industrial land rental prices in prime locations and warehouses in old projects have increased sharply.

Land rental prices in prime locations in Binh Duong, Dong Nai, and Long An have increased by 5-10% compared to the same period last year.

Ready-built factory rental prices remain stable.

Warehouse rental prices have increased by 10-15% in old projects compared to the same period last year.

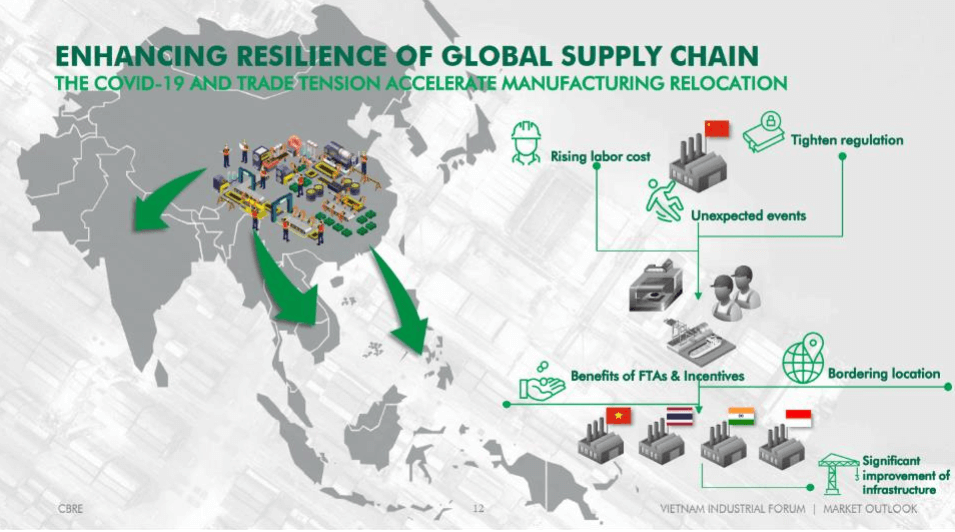

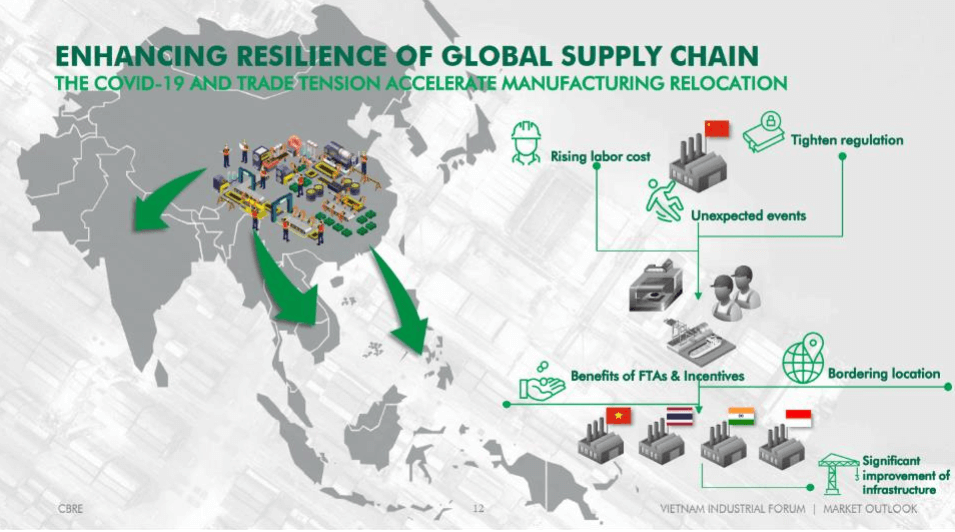

Covid-19 and trade tensions are driving manufacturing relocation and strengthening global supply chain recovery.

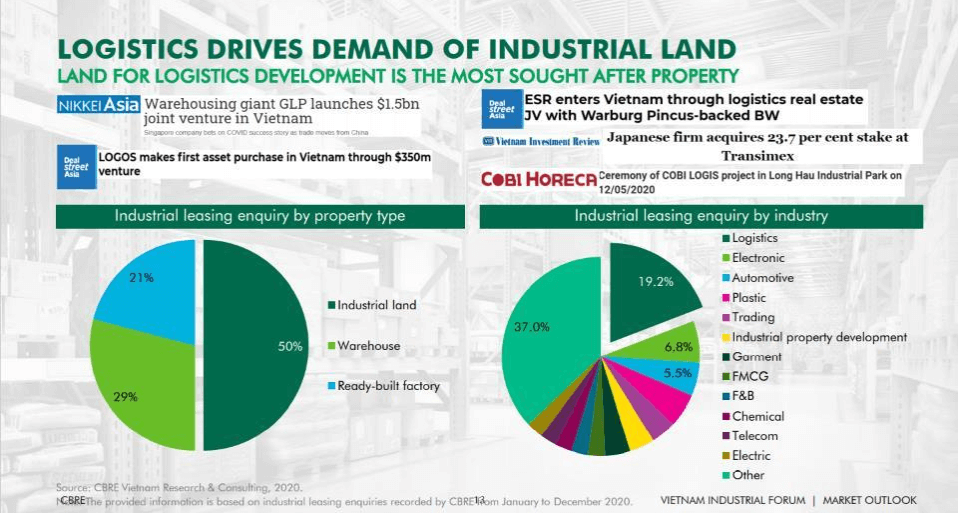

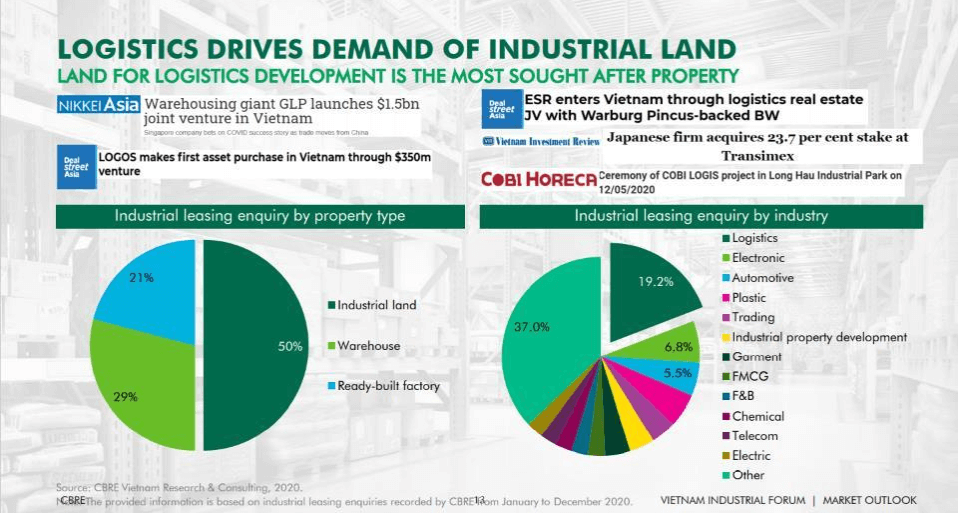

Land demand for logistics development purposes is the most sought after after urban real estate.

Opportunity for Vietnam

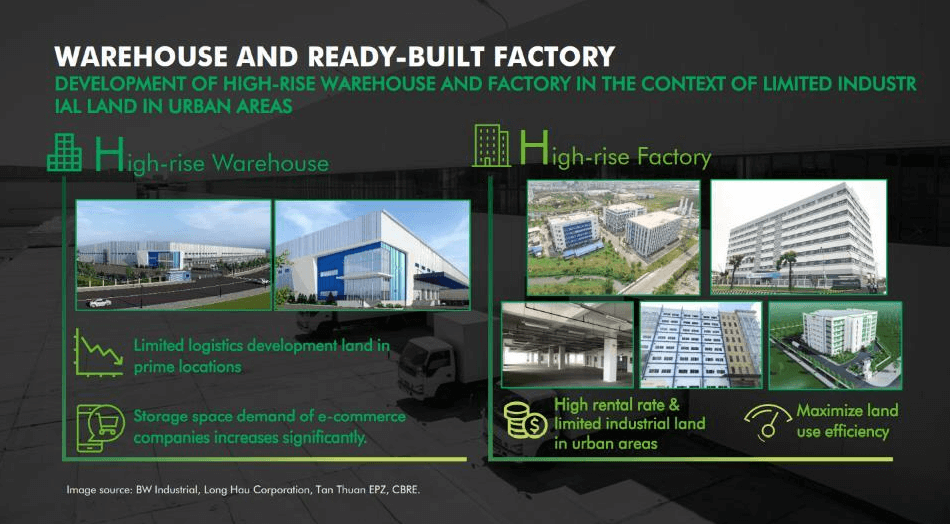

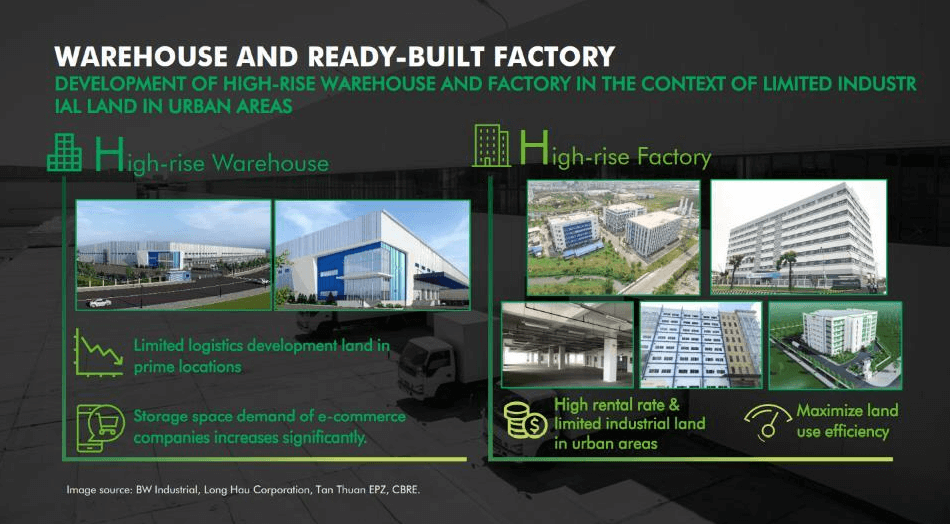

The development of high-rise warehouses and factories in the context of limited industrial land in residential areas, because:

- Land for logistics development in prime locations is limited.

- The demand for storage space of e-commerce companies has increased significantly

- High rents & limited land in residential areas.

- Maximizing land use efficiency.

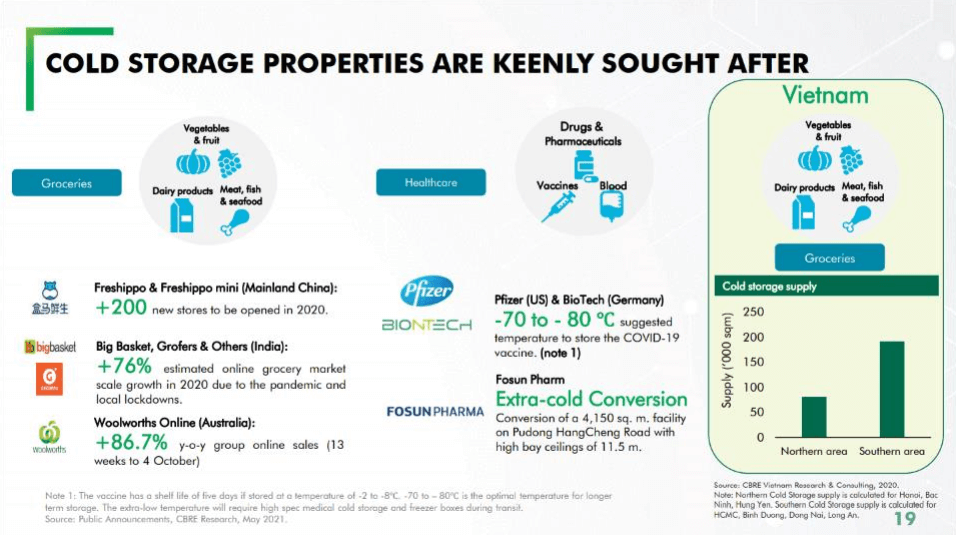

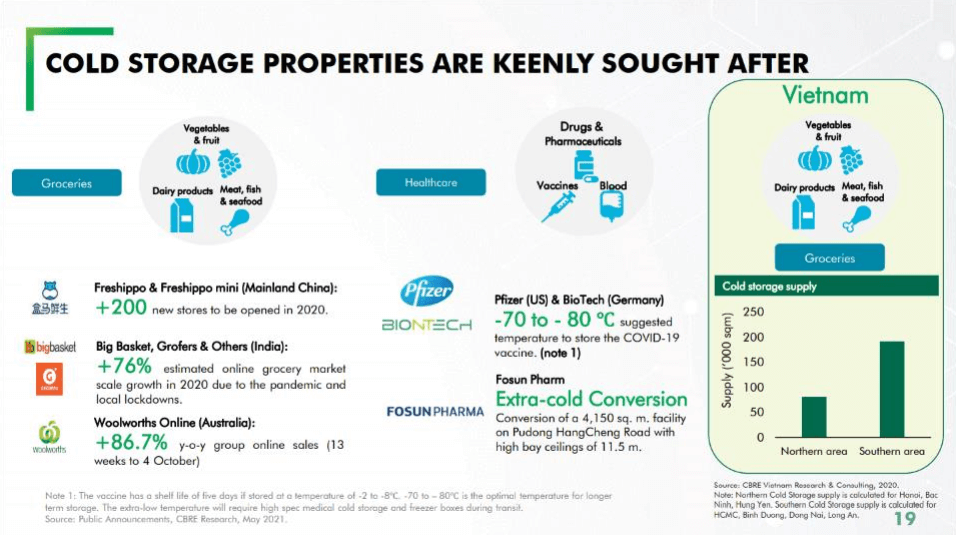

Cold storage real estate is enthusiastically sought after by investors.

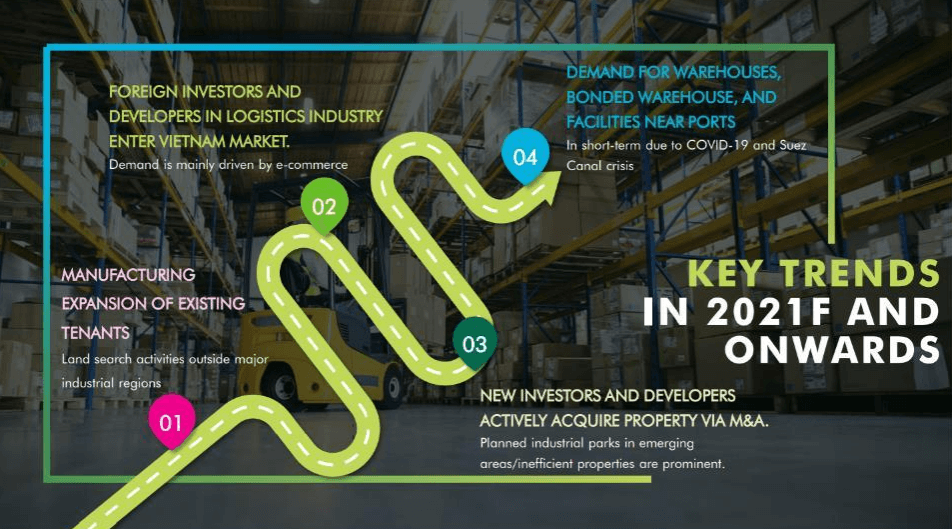

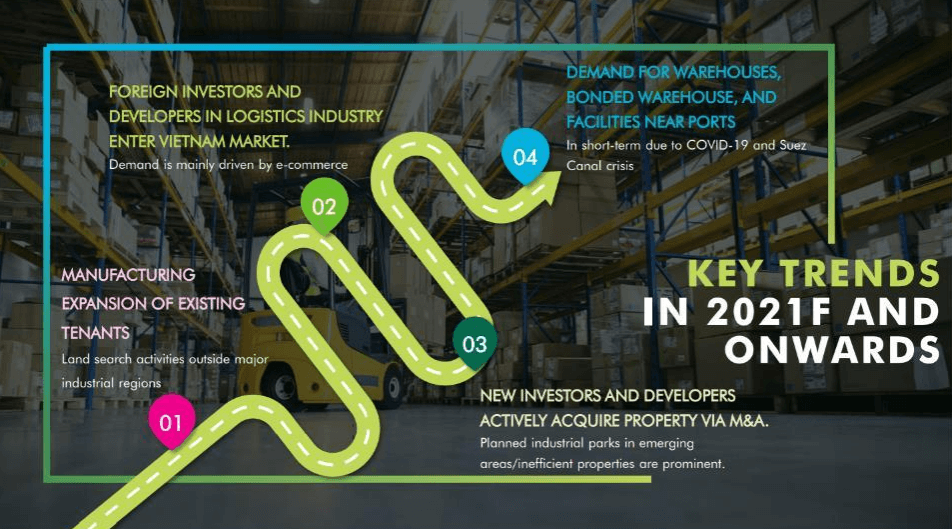

Key trends in 2021:

- Existing businesses expanding production: New land acquisition activities are mostly outside of major industrial areas.

- Investors and developers in the logistics industry entering the Vietnamese market: Demand is largely driven by e-commerce.

- Demand for warehouses and bonded warehouses near ports: Short-term due to the global Covid-19 pandemic and the Suez Canal crisis.

- New investors actively acquiring assets through M&A: Industrial parks planned in emerging areas or underperforming real estate areas are prominent.

To see more detailed information, you can download the file at this link!

Download report file: Link

越南工业地产市场的主要前景及机遇:

越南北部和南部可供租赁的工业地产土地储备仍然有限,占比仅为20%。

北部地区:

可供租赁的工业地产土地储备:9,600公顷

出租率:79%

南部地区:

可供租赁的工业地产土地储备:25,000公顷

出租率:78%

仓库和现成工厂的供应量与去年同期相比大幅增加,主要集中在工业园区。

北方地区:

仓库供应量达到113万平方米,同比增长4.4%。

预建工厂供应量达到214万平方米,同比增长1.9%。

南方地区:

仓库供应量达到300万平方米,同比增长15%。

预建工厂供应量达到290万平方米,同比增长7%。

黄金地段工业用地租金和老项目仓库租金大幅上涨。

平阳、同奈和隆安等省黄金地段的土地租金与去年同期相比上涨了5-10%。

现房厂房租金保持稳定。

老项目仓库租金与去年同期相比上涨了10-15%。

新冠疫情和贸易紧张局势正在推动制造业外移,并加强全球供应链复苏。

物流开发用地需求是继城市房地产之后最受追捧的土地需求。

越南的机遇

在住宅区工业用地有限的背景下,开发高层仓库和工厂,原因如下:

- 黄金地段的物流开发用地有限。

- 电商企业对仓储空间的需求大幅增长。

- 住宅区租金高昂,土地有限。

- 最大限度地提高土地利用效率。

冷藏地产受到投资者热烈追捧。

2021年的主要趋势:

- 现有企业扩大生产:新增土地收购活动大多位于主要工业区之外。

- 物流行业投资者和开发商进入越南市场:需求主要受电商驱动。

- 港口附近仓库和保税仓库的需求:受全球新冠疫情和苏伊士运河危机影响,短期内需求将有所回升。

- 新投资者积极通过并购收购资产:在新兴地区或房地产表现不佳的地区规划的工业园区尤为突出。

要查看更多详细信息,您可以通过此链接下载文件!

Download report file: Link

Consultant 5 years experience