[Thanh Hoa] Bim Son Industrial Park

June 19, 2025Overview of Bim Son Industrial Park project

Bim Son industrial park favorable in terms of geographical location, electricity and water supply, transportation and services, easy to attract skilled labor, land costs and infrastructure investment are much lower than other industrial parks in Northern Vietnam.

With potential advantages, Bim Son A Industrial Park will be an attractive and successful investment opportunity and destination for domestic and international investors.

Project name: Bim Son Industrial Park

Location: Area A, Bim Son Industrial Park, Bac Son Ward, Bim Son Town, Thanh Hoa Province

Scale: 163,360 ha

Investor: VID – Thanh Hoa Investment and Development Company

Starting time: 2013

Project operation time: until 2063

Phối cảnh dự án Khu công nghiệp Bỉm Sơn

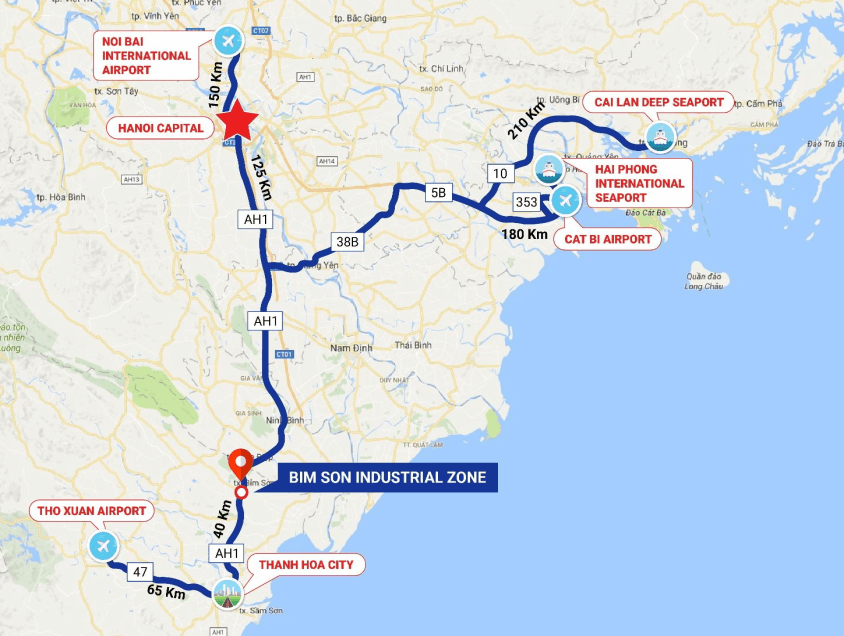

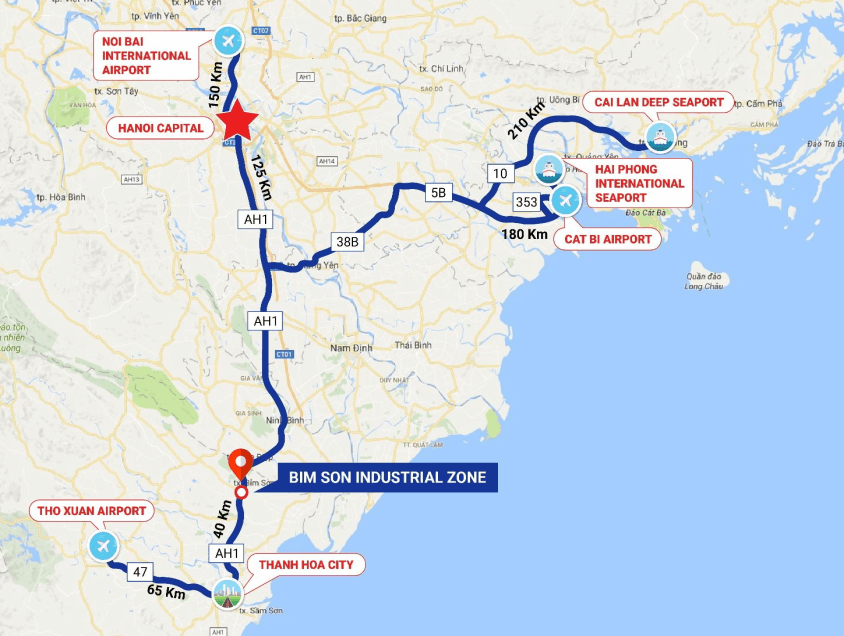

Location Bim Son Industrial Park

Distance to major cities:

32 km from Thanh Hoa City,

120 km from Hanoi,

Nearest seaport:

35 km from Le Mon port,

97 km from Nghi Son deep-water port

Nearest airport:

40 km from Thanh Hoa airport (planned),

140 km from Noi Bai International Airport

Nearest railway station:

Near Bim Son station – on the North-South railway axis

Location Bim Son Industrial Park

Infrastructure of Bim Son Industrial Park

Ground:

The land is leveled to achieve compaction: K>=0.9

Leveling height: 15m

Road system:

The internal traffic system is built to ensure that vehicles can easily and conveniently reach each factory:

Main axis width: 40m,

Sub-axis width: 22.5m

Power system:

Supplied by 02 110/35kV – 125+25 MVA transformer stations along the internal roads of the Industrial Park to ensure stable power supply for production for enterprises.

Clean water:

1 water supply plant with a capacity of 15,000m3/day ensures quality and quantity to serve the production and living needs of each enterprise.

Wastewater treatment plant with capacity up to 6,000m2/day (full capacity: 32,000m3/day)

Wastewater will be collected from factories in the area and pre-treated to meet TCVN type B standards before being discharged into the centralized wastewater treatment plant of the Industrial Park.

Telecommunication and information technology system:

Modern IT system with diverse services, such as mobile phones, high-speed internet

Security system:

Modern security system is controlled and operated by a system of well-trained staff

Current status of Bim Son Industrial Park planning

Total planned area 150 ha

Area available for lease 50 ha

Overview of Bim Son Industrial Park planning perspective

Investment attraction areas

▪Agricultural and forestry processing industry;

▪ Household appliances and handicrafts manufacturing industry;

▪ Machinery assembly, repair, high-tech industry;

▪ Garment and packaging industry;

▪ Petrochemical manufacturing industry,…

Investment incentives policy

Exemption from import tax on machinery to create fixed assets:

- Equipment, machinery.

- Imported raw materials and materials for the production of equipment, machinery in technological lines or equipment, spare parts, molds, accessories accompanying equipment, machinery.

- Specialized transportation in technological lines, transporting workers (over 24 seats).

- Construction materials that cannot be produced locally.

- Equipment, spare parts, molds, accessories accompanying equipment, machinery, means of transport and specialized means of transport.

Exemption from export tax for imported raw materials and supplies for the production of export goods:

Exemption from export tax for raw materials for production in the list of projects with special investment incentives for 5 years from the start of production (If the enterprise invests in the list of projects with special investment incentives or invests in the production of spare parts, or mechanics, electronics, etc.)

Taxes paid abroad

Tax exemption for overseas remittances

VAT

VAT exemption for imported goods including raw materials for production and processing of export goods under processing contracts signed with foreign partners.

Corporate income tax is 25%

For newly established enterprises in industrial parks with high-tech projects as prescribed by law, software projects, the tax rate of 10% is applied for 15 years, tax exemption for 04 years and 50% reduction for the next 09 years.

For high-tech projects, large scale that need to attract investment, the preferential tax rate of 10% can be extended but not exceeding 30 years. After the above preferential period, the corporate income tax rate applied is 25%.

The preferential tax rate is calculated from the first year the enterprise has taxable income. If the enterprise has no taxable income in the first three years from the first year but has revenue, the tax exemption or reduction is calculated from the fourth year.

Bim Son Industrial Park Planning Map

Đang cập nhật

Bim Son Industrial Park Project Evaluation

Bim Son Industrial Park has the advantage of a prime geographical location with modern infrastructure, helping to attract many domestic and foreign investors.

The industrial park prioritizes attracting many key industries and possesses an abundant labor force, so it attracts many investors.

Extremely attractive investment incentives and good support services for investors.

Services of Vietnam Property Hub

- Investment promotion (land, factories) in industrial parks, industrial clusters and commercial service land, …

- Legal support & Investment consulting in areas related to industrial real estate.

- Connecting and cooperating in industrial real estate investment.

Contact consultant

Bim Son工业园区项目概况

滨山工业园区地理位置优越,水电供应充足,交通便利,服务完善,易于吸引熟练劳动力,土地成本和基础设施投资远低于越南北部其他工业园区。

滨山A工业园区凭借其潜在的优势,将成为国内外投资者极具吸引力的投资良机和成功目的地。

项目名称:滨山工业园区

地点:清化省滨山镇北山坊滨山工业园区A区

规模:163,360公顷

投资者:清化投资发展公司(VID)

开工时间:2013年

项目运营期限:至2063年

Phối cảnh dự án Khu công nghiệp Bỉm Sơn

地点:Bim Son 工业园区

滨山工业园区位于1A国道西侧,清化省北部,靠近南北铁路。

距离主要城市:

距离清化市32公里,

距离河内120公里,

距离最近的海港:

距离黎蒙港35公里,

距离宜山深水港97公里。

距离最近的机场:

距离清化机场(规划中)40公里,

距离内排国际机场140公里。

距离最近的火车站:

靠近滨山站 – 位于南北铁路轴线上。

地点:Bim Son 工业园区

Bim Son工业园区基础设施

地面:

土地已平整,压实度达到:K>=0.9

平整高度:15米

道路系统:

园区内部交通系统完善,确保车辆便捷通达各厂区:

主轴线宽度:40米,

副轴宽度:22.5米

电力系统:

园区内部道路沿线设有两座110/35千伏-125+25兆伏安变电站,确保企业生产用电稳定。

清洁水源:

园区建有一座供水能力为1.5万立方米/天的自来水厂,确保水质和水量,满足各企业的生产生活需求。

废水处理:

污水处理厂,处理能力高达 6,000 平方米/天(满负荷:32,000 立方米/天)。

废水将从区域内的工厂收集,并进行预处理,达到 TCVN B 类标准,然后排入工业园区的集中污水处理厂。

电信和信息技术系统:

现代化的 IT 系统,提供多种服务,例如移动电话、高速互联网。

安保系统:

现代化的安保系统由训练有素的人员控制和操作。

Bim Son工业园区规划现状

总规划面积150公顷

可出租面积50公顷

滨山工业园区规划前景概述

招商引资领域

▪农林加工业;

▪家用电器及手工艺品制造业;

▪机械装配、修理及高新技术产业;

▪服装及包装业;

▪石油化工制造业……

投资激励政策

用于生产固定资产的机器免征进口税:

设备、机械。

用于生产设备、工艺生产线上的机械或设备、备件、模具、设备及机械随附配件的进口原材料和材料。

用于工艺生产线的专用运输工具,用于运送工人(超过24个座位)。

本地无法生产的建筑材料。

设备、备件、模具、设备及机械随附配件、运输工具和专用运输工具。

用于生产出口产品的进口原材料和物资免征出口税:

用于生产特殊投资优惠项目清单中的原材料,自生产开始之日起5年内免征出口税(如果企业投资于特殊投资优惠项目清单或投资于备件、机械、电子产品等的生产)。

境外缴纳税款

海外汇款免税

增值税

根据与外商签订的加工贸易合同,进口货物(包括用于生产加工出口货物的原材料)免征增值税。

企业所得税为25%

对在工业园区内新办的、符合法律规定的高新技术项目、软件项目,可享受15年10%的所得税优惠,第4年免税,第9年减半征收企业所得税。

对于需要招商引资的大型高新技术项目,可延长10%的所得税优惠期,但最长不超过30年。上述优惠期满后,企业所得税税率为25%。

优惠税率自企业获得应税收入的第一年起计算。如果企业自第一年起前三年无应税收入,但有营业收入,则从第四年起免税或减税。

滨山工业园区规划图

Đang cập nhật

滨山工业园区项目评估

滨山工业园区地理位置优越,基础设施先进,吸引了众多国内外投资者。

该工业园区重点发展多个重点产业,劳动力资源充足,吸引了众多投资者。

极具吸引力的投资激励措施和完善的配套服务,为投资者提供良好的支持。

越南房地产中心的服务

- 工业园区、产业集群和商业服务用地的招商引资(土地、工厂)……

- 工业地产相关领域的法律支持和投资咨询。

- 工业地产投资对接与合作。

联系顾问

Consultant 5 years experience