Overview of Dong Binh Industrial Park project

June 19, 2025Overview of Dong Binh Industrial Park project

Project name: Dong Binh Industrial Park

Location: Dong Binh Commune and Dong Hung 1 Hamlet, Dong Hung 2 Hamlet – Dong Thanh Commune, Binh Minh Town, Vinh Long Province

Scale: 351 ha

Investor: TNI Vinh Long Investment Joint Stock Company

Starting time: 2021

Project operation time: until 2071

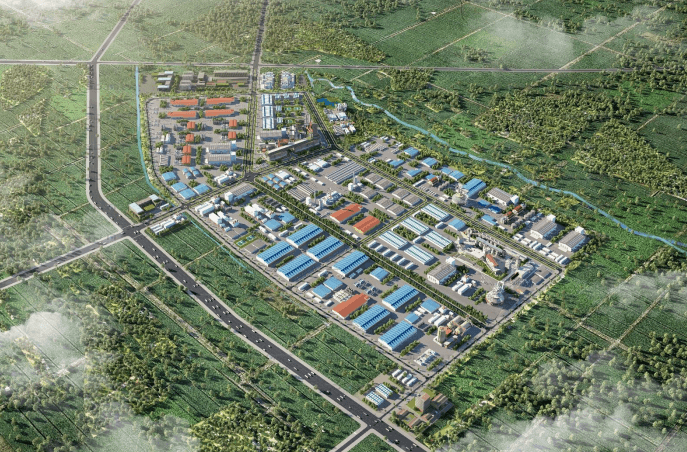

Perspective of Dong Binh Industrial Park project

Location Dong Binh Industrial Park

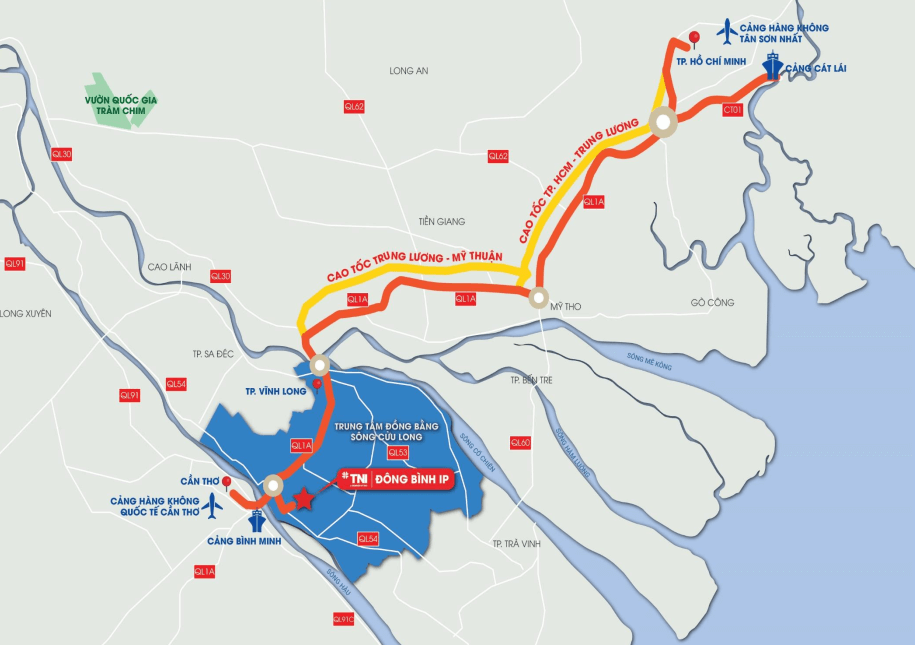

Dong Binh Industrial Park is located in Dong Binh Commune, Binh Minh District, Vinh Long Province.

3 km from National Highway 1A

12 km from Can Tho City,

33 km from Vinh Long City,

167 km from Ho Chi Minh City

Distance to the airport:

About 22 km from Can Tho Airport (Tra Noc Airport)

Distance to the nearest ports:

Binh Minh Port within Binh Minh Industrial Park: 07 km, capable of receiving ships with a capacity of 15,000 to 20,000 tons.

Vinh Long Port: 33 km. Can receive ships with a capacity of up to 3,000 tons. Five banks of the Co Chien River in Vinh Long City. The port has a warehouse system of over 40,000 tons.

Cai Cui Can Tho Port: 22 km. With a cargo handling capacity of 526,904 tons/year, the port has put into operation 02 wharves with a capacity of about 30,000 tons and ships with a capacity of 5,000 to 10,000 tons docking, with a total warehouse area of 39,924 m2.

Location Dong Binh Industrial Park

Regional connectivity of Dong Binh Industrial Park

Infrastructure of Dong Binh Industrial Park

Internal road system:

Main axis: 52 m

Secondary axis: 17 m

Electricity system:

Supplied from the national grid along National Highway 1A by Vinh Long Power Company to the industrial park fence, the enterprise invests in lowering the grid itself.

110kv power station optimizes the capacity of electricity used to support the factory to the maximum.

Water supply system:

Water supply situation: install the entire clean water supply system to the industrial park fence (meter, pipeline …), the remaining units can connect water to their own units or hire Vinh Long Water Supply Company Limited to provide connection services.

Water standards according to QCVN 01:2009/BYT.

Water supply plant with a capacity of 12,000 m3/day

Wastewater treatment plant:

Wastewater treatment plant with a capacity of up to 8600 m3/day.

Information system:

Telecommunications, Internet and other utilities are connected to the enterprise provided by telecommunications (VNPT, Viettel, ….) to manage and provide services:

Fixed telephone service (PSTN): there are many options to choose from (with price list attached)

Internet service: there is ADSL (normal speed), FTTH (high-speed Internet) for Internet access, watching movies, listening to music, downloading movies, downloading music, video calling, online meetings …; transmission speed depends on the package.

Electronic signature registration service: convenient for online tax declaration, electronic customs declaration, electronic banking transactions, electronic securities, electronic document signing, other types of transactions via electronic networks…

Transportation monitoring and management system service: used to monitor routes, locations, various reporting systems, serving management needs.

Cable TV: domestic and international channels.

Support for used devices: wifi, fiber optic, ODF, Converter…

Security System:

Modern security system controlled and operated by a system of well-trained staff.

Land use planning system of Dong Binh Industrial Park

Total area of the entire industrial park: 351 ha

Factory and warehouse land: 258.83 ha, accounting for 73.95%

Administrative and service land: 6.27 ha, accounting for 1.79%

Green land, water surface: 39.21 ha, accounting for 11.20 ha

Traffic land: 40.11 ha, accounting for 11.46 ha

Land within the scope of National Highway 54 expansion (previously not included in the planning) is now 0.66 ha, accounting for 0.19%

Overview of planning of the entire Dong Binh Industrial Park project

Investment attraction areas

Food – foodstuff, processing of vegetables, tubers, fruits and fruit products;

Seafood processing;

Livestock products;

Consumer goods industry, packaging,

Chemical industry,

Pharmaceutical and medical supplies manufacturing and processing

Some other industries with less environmental pollution.

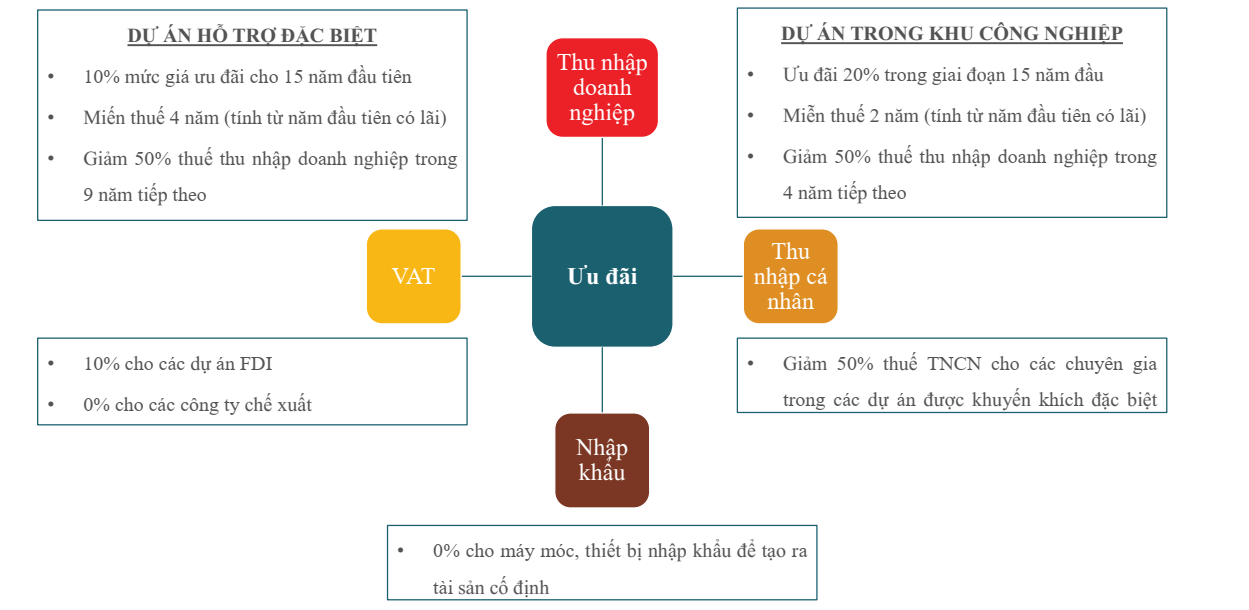

Investment incentives policy

Import tax:

Imported goods to create fixed assets of investment projects in fields with preferential import tax as prescribed in Appendix 1 issued together with Decree No. 87/2010/ND-CP detailing the implementation of the Law on Import and Export Tax or areas with preferential import tax, investment projects using official development assistance (ODA) capital are exempted from import tax, including:

Equipment, machinery;

Specialized means of transport in technological lines that cannot be produced domestically; means of transporting workers including cars with 24 seats or more and water vehicles;

Components, details, separate parts, spare parts, fixtures, molds, accessories for synchronous assembly with equipment, machinery, specialized means of transport as prescribed in Points a and b of this Clause;

Raw materials and supplies that are not yet produced domestically are used to manufacture equipment and machinery in technological lines or to manufacture components, details, separate parts, spare parts, fixtures, molds, and accompanying accessories for synchronous assembly with equipment and machinery specified in Point a of this Clause; Construction materials that are not yet produced domestically.

(Thông tin chi tiết tham khảo tại Điều 12,13,14 của Nghị định số 87/2010/NĐ-CP Quy định chi tiết thi hành luật thuế XNK)

Corporate income tax:

Corporate income tax rate is 25%.

The preferential tax rate of 10% for a period of 15 years applies to: Newly established enterprises from investment projects in the following fields: High technology as prescribed by law (List of high technology and list of high technology products under Decision No. 49/2010/QD-TTg dated July 19, 2010 of the Prime Minister on approving the list of high technologies prioritized for investment and development and the list of high technology products encouraged for development); scientific research and technological development; Software product manufacturing. Tax exemption for 4 years, 50% reduction of payable tax in the next 9 years. The tax exemption and reduction period prescribed in this Article is calculated continuously from the first year the enterprise has taxable income from the investment project; In case an enterprise has no taxable income in the first three years, from the first year of revenue from the investment project, the tax exemption or reduction period shall be calculated from the fourth year.

(Detailed regulations in Article 15 of Decree No. 124/2008/ND-CP)

Other incentives:

Advertising cost incentives: Within 03 years, from the date the investment project comes into operation, 50% of product advertising costs will be supported (through Radio, Television and Vinh Long Newspaper) with a maximum support level of no more than 02 million VND/time and a maximum of 06 times/year.

Investment and Trade Promotion Funding:

Those who have contributed to calling for investment and mobilizing, and promoting the necessary work for projects of investors outside the province and abroad to be granted investment certificates, when the project is implemented and basically completed and put into production and business operations, will be rewarded by the Provincial People’s Committee with 0.2% of the total construction capital and equipment of the project that has been settled (through the Center for Trade and Investment Promotion). The monetary bonus is stipulated as follows:

For projects with domestic investment capital (investors outside the province): The maximum bonus is not more than 60 million VND/project.

For projects with foreign investment capital (Only counting 3 forms of investment such as: Business cooperation contract, 100% foreign capital and joint venture): The maximum bonus is not more than 15,000 USD/project.

Investment incentives policy in Dong Binh Industrial Park

Dong Binh Industrial Park Project Planning Map

Đang cập nhật

Evaluation of Dong Binh Industrial Park project

The industrial park has a strategic location in the center of the Mekong Delta, easily connecting with provinces

Adjacent to Binh Minh Port and next to Can Tho International Airport.

Open investment environment with attractive investment policies.

Investment costs in the industrial park are reasonable.

Services of Vietnam Property Hub

- Investment promotion (land, factories) in industrial parks, industrial clusters and commercial service land, …

- Legal support & Investment consulting in areas related to industrial real estate.

- Connecting and cooperating in industrial real estate investment.

Contact consultant

Consultant 5 years experience