[Vinh Long] Binh Minh Industrial Park

June 19, 2025Overview of Binh Minh Industrial Park project

Binh Minh industrial park is a project located in Vinh Long province – the center of the Mekong Delta, connecting the entire Southwest region with Ho Chi Minh City and the whole country. The complete waterway and road traffic system is convenient for transportation, exchange of raw materials and circulation of goods. This is not only a place known as favorable location – harmony, but also promises to become a land full of potential for real estate investment in particular and large-scale economy in general.

Project name: Binh Minh industrial park

Location: Binh Minh District, Vinh Long Province

Scale: 90 ha

Investor: Hoang Quan Mekong Real Estate Joint Stock Company

Starting time: 2006

Project operation time: until 2056

Perspective of Binh Minh Industrial Park

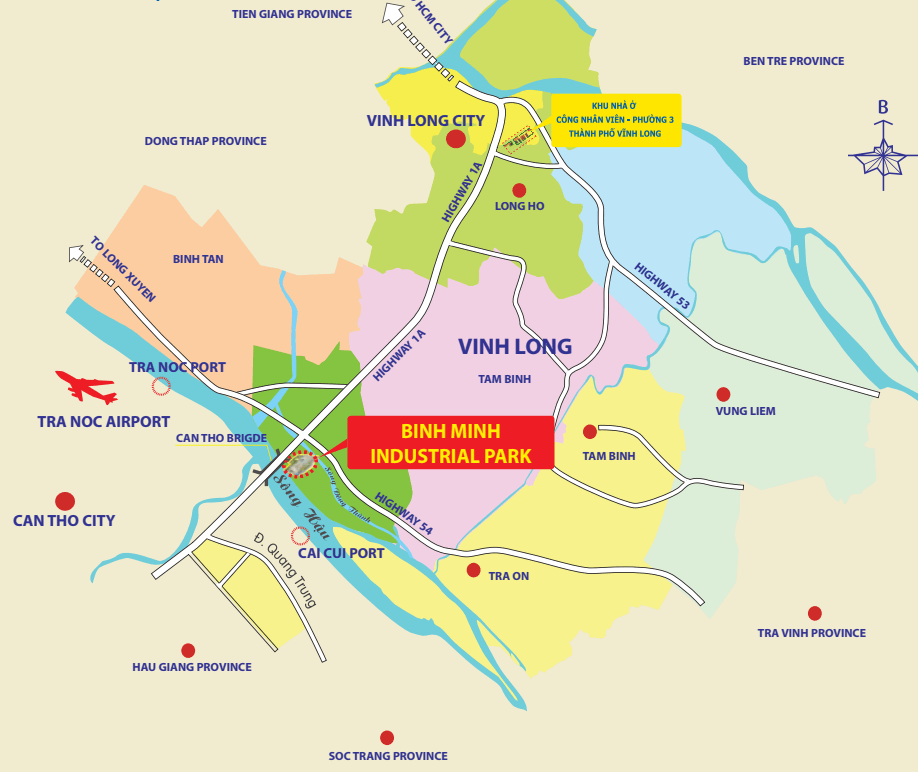

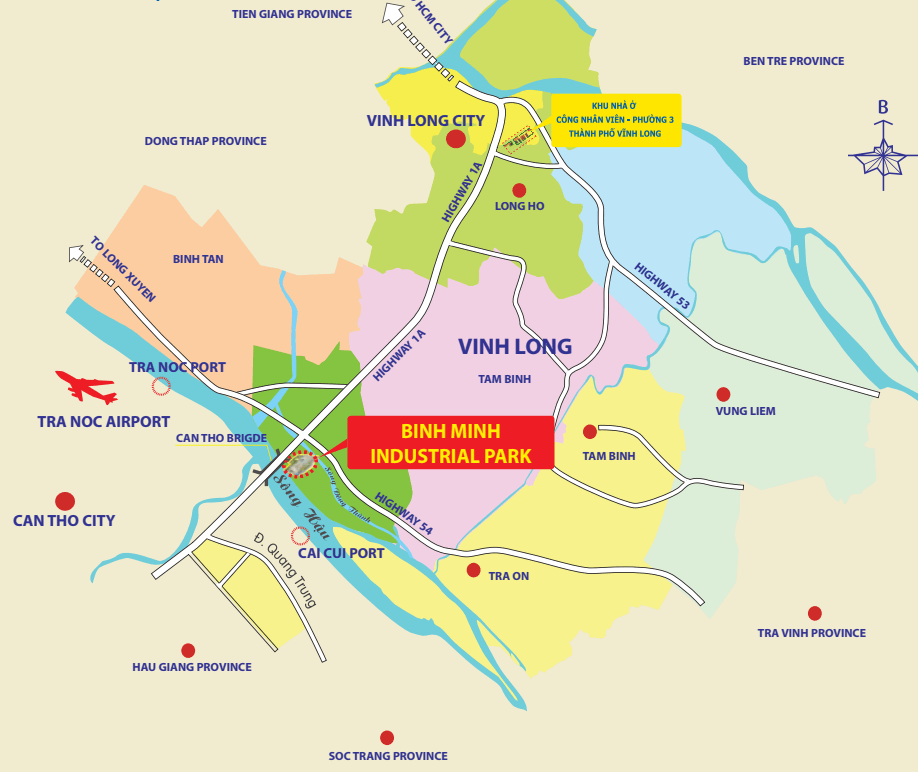

Location of Binh Minh Industrial Park

Binh Minh industrial park located in Binh Minh District, Vinh Long Province.

- Distance from Ho Chi Minh City: 124km (follow Ho Chi Minh City to Can Tho Expressway).

- Distance from Can Tho City: 5km.

- Distance from Vinh Long City: 30km.

- Distance from Tra Noc Airport: 15km.

- Distance from Cai Cui Port: 5km.

Location of Binh Minh Industrial Park

Convenient transportation to the Industrial Park by many routes:

- Road: next to the Industrial Park is National Highway 1A through Can Tho Bridge to the Mekong Delta provinces or Trung Luong – Can Tho Expressway.

- Waterway: to Binh Minh Port.\

- Airway: Tra Noc International Airport (Can Tho City) is 15km from the project.

Infrastructure of Binh Minh Industrial Park

Internal traffic system: 40m main road, 27-40m internal road connecting Can Tho bridge intersection, paved with hot asphalt concrete and designed according to Vietnam H30 standard.

Infrastructure of Binh Minh Industrial Park

Power system: 110/158/2KV source, capacity 20,000KW, capacity 25MVA.

Clean water supply system from two sources: Industrial Park water plant (capacity 7,000m3/day and night) Vinh Long water supply plant.

Drainage system: separate rainwater and wastewater drainage system, connected to the wastewater treatment plant.

Wastewater treatment plant: treatment capacity 5,000m3/day and night. Enterprises internally treat wastewater to column B standards, Industrial Parks internally treat wastewater to column A standards (according to QCVN40: 2011/BTNMT) before discharging into Hau River.

Communication system: 5000-number telephone network, internet, DSL, fiber optic cable connected to Vinh Long Provincial Post Office telecommunications network.

Amenities around the industrial park: port cluster, expert housing, customs, bank, green park…

Current status of land use planning of Binh Minh Industrial Park

Total area of the whole area is 162 ha, including:

- Industrial park area: 90 ha.

- Port and warehouse area: 42 ha.

- Expert and employee housing area: 30 ha.

Binh Minh Industrial Park Planning Map

Priority areas for investment attraction

Agriculture and aquaculture: rice, agricultural product processing, fruits, animal feed, etc.

Supporting industries for the agricultural economy of the Mekong Delta.

All manufacturing industries with clean technology or low pollution.

Spinning, dyeing, garment.

Investment in warehouses, factories, logistics services, etc.

Investment incentives policy

Corporate income tax rate:

From January 1, 2014, the Law amending and supplementing a number of articles of the Law on Corporate Income Tax dated June 19, 2013 will take effect. Accordingly, enterprises will enjoy the following corporate income tax rates:

- Corporate income tax rate is 22%

- From January 1, 2016, cases subject to the corporate income tax rate of 22% will be reduced to 20%.

- The corporate income tax rate is 20% for enterprises with total revenue of the previous year not exceeding 20 billion.

- The corporate income tax rate for activities of searching, exploring, and exploiting oil, gas and other rare resources in Vietnam ranges from 32% to 50%, depending on each project and each business establishment.

Preferential tax rate:

- According to the provisions of Decree 218/2013/ND-CP dated December 26, 2013 detailing and guiding the implementation of the Law on Corporate Income Tax, effective from February 15, 2014, enterprises enjoy preferential corporate income tax rates as follows: Preferential tax rate of 10% for 15 years, for: Income of enterprises from implementing new investment projects in the following fields: software product production; production of composite materials, light construction materials, rare materials; …

Enterprise income from implementing new investment projects in the manufacturing sector (except for projects producing goods subject to special consumption tax and mineral exploitation), meeting one of the following two criteria:

The project has a minimum investment capital of VND 6 trillion, disbursement within no more than 03 years from the date of investment license issuance and a minimum total revenue of VND 10 trillion/year no later than 03 years from the year of revenue.

The project has a minimum investment capital of VND 6 trillion, disbursement within no more than 03 years from the date of investment license issuance and employs over 3,000 workers no later than 03 years from the year of revenue. - Preferential tax rate of 20% for 15 years (from January 1, 2016, tax rate of 17%) applies to: Income of enterprises from implementing new investment projects: production of high-grade steel; production of energy-saving products; production of machinery and equipment for agricultural, forestry, fishery and salt production; production of irrigation equipment; production and refining of animal feed, poultry and aquatic products; development of traditional industries. The period of application of preferential tax rates prescribed in this Article (Article 15, Decree 218/2013/ND-CP) is calculated continuously from the first year the enterprise has revenue from the new investment project.

Tax exemption, tax reduction:

Tax exemption for 04 years, 50% reduction of tax payable in the next 9 years.

Tax exemption for 02 years, 50% reduction of tax payable in the next 04 years for enterprise income from implementing new investment projects in industrial parks.

The tax exemption and tax reduction period prescribed in this Article is calculated continuously from the first year of taxable income from the new investment project enjoying tax incentives. In case there is no taxable income in the first 3 years, from the first year of revenue from the new investment project, the tax exemption and tax reduction period is calculated from the fourth year.

Binh Minh Industrial Park Project Planning Map

Download high quality file of industrial park planning map: Link

Binh Minh Industrial Park Review

- The industrial park is planned and invested in synchronous infrastructure: there is a port cluster and housing for experts right at the industrial park.

- Binh Minh Industrial Park has regional advantages: located in a densely populated area, abundant labor force, potential natural resources and rich food sources.

- Land and factories are rented at reasonable prices, flexible and competitive payments.

- Enterprises investing in Binh Minh Industrial Park enjoy investment incentives according to the law and are supported by Hoang Quan Mekong with free legal advice on investment and business establishment.

- Enterprises are served by a team of enthusiastic staff with extensive experience in the field of industrial parks, ready to advise enterprises on all procedures before and after investment.

- Traffic to the industrial park is increasingly convenient, shortening travel time for enterprises because the Mekong Delta region is receiving great attention from the State in investing in traffic infrastructure in many aspects.

Services of Vietnam Property Hub

- Investment promotion (land, factories) in industrial parks, industrial clusters and commercial service land, …

- Legal support & Investment consulting in areas related to industrial real estate.

- Connecting and cooperating in industrial real estate investment.

Contact consultant

平明工业园区项目概况

平明工业园区位于湄公河三角洲中心永隆省,连接整个西南地区、胡志明市乃至全国。完善的水路和公路交通系统,方便运输、原材料交换和货物流通。这里不仅享有“和谐”的优越地理位置,而且有望成为一片充满潜力的土地,尤其适合房地产投资,并有望发展成为规模经济。

项目名称:平明工业园区

地点:永隆省平明县

规模:90公顷

投资者:皇官湄公房地产股份公司

开工时间:2006年

项目运营期限:至2056年

平明工业园区全景

平明工业园区位置

平明工业园区位于永隆省平明县。

- 距离胡志明市:124公里(沿胡志明市至芹苴高速公路行驶)。

- 距离芹苴市:5公里。

- 距离永隆市:30公里。

- 距离茶诺机场:15公里。

- 距离蔡崔港:5公里。

平明工业园区位置

交通便利,多条线路可轻松抵达工业园区:

公路:工业园区旁有1A国道,经芹苴大桥可通往湄公河三角洲各省,或经忠良-芹苴高速公路。

水路:可抵达平明港。

空路:茶诺国际机场(芹苴市)距离项目15公里。

平明工业园区基础设施

内部交通系统:主干道40米,连接芹苴桥交叉口的内部道路27-40米,采用热沥青混凝土铺设,按照越南H30标准设计。

平明工业园区基础设施

电力系统:110/158/2KV电源,容量20,000KW,容量25MVA。

清洁水供应系统由两个水源组成:工业园区自来水厂(日均处理能力7,000立方米)和永隆供水厂。

排水系统:雨污分流系统,与污水处理厂连接。

污水处理厂:处理能力5,000立方米/日均处理能力。企业内部污水处理至B级标准,工业园区内部污水处理至A级标准(根据QCVN40: 2011/BTNMT标准),然后排入后河。

通讯系统:5000号码电话网络、互联网、DSL、光纤电缆,连接到永隆省邮局电信网络。

工业园区周边配套设施:港口群、专家公寓、海关、银行、绿地……

平明工业园区土地利用规划现状

总占地面积162公顷,其中:

工业园区:90公顷;

港口及仓库:42公顷;

专家及员工住房:30公顷。

平明工业园区规划图

招商引资重点领域

农业和水产养殖:稻米、农产品加工、水果、动物饲料等。

湄公河三角洲农业经济的支撑产业。

所有采用清洁技术或低污染的制造业。

纺织、印染、服装。

投资仓储、工厂、物流服务等。

投资激励政策

企业所得税税率:

2013年6月19日颁布的《企业所得税法》若干条款的修订及补充法将于2014年1月1日起生效。据此,企业将享受以下企业所得税税率:

企业所得税税率为22%

自2016年1月1日起,适用22%企业所得税税率的企业将降至20%。

上一年度总收入不超过200亿越南盾的企业,企业所得税税率为20%。

在越南,从事石油、天然气及其他稀缺资源的勘探、开采和开发活动的企业所得税税率为32%至50%,具体税率取决于具体项目和具体企业类型。

优惠税率:

- 根据2013年12月26日第218/2013/ND-CP号法令关于细化和指导《企业所得税法》实施的规定,自2014年2月15日起,企业可享受以下优惠企业所得税税率:10%的优惠税率,为期15年,适用于:企业在以下领域实施新投资项目所取得的收益:软件产品生产;复合材料、轻质建筑材料、稀有材料生产;……

- 企业在制造业实施新投资项目所取得的收益(生产特别消费税征收商品和矿产开采的项目除外),需满足以下两个条件之一:

项目投资资本最低为6万亿越南盾,自投资许可证签发之日起3年内到位,且自收入年度起3年内,年总收入最低为10万亿越南盾。

该项目最低投资额为6万亿越南盾,自投资许可证颁发之日起3年内到位,并自产生收入之日起3年内雇佣3000名以上员工。

优惠税率为20%,为期15年(自2016年1月1日起,税率为17%),适用于:企业实施新投资项目的收入:生产优质钢材;生产节能产品;生产农业、林业、渔业和盐业机械设备;生产灌溉设备;生产和精炼动物饲料、家禽和水产品;发展传统产业。本条规定的优惠税率适用期(第218/2013/ND-CP号法令第15条)从企业从新投资项目获得收入的第一年起连续计算。.

免税、减税:

免税4年,之后9年应纳税额减半。

在工业园区实施新投资项目的企业所得,免税2年,之后4年应纳税额减半。

本条规定的减免税期限,自享受税收优惠的新投资项目产生第一年应纳税所得额起连续计算。如果前3年没有产生应纳税所得额,则从新投资项目产生第一年收入起,减免税期限从第四年开始计算。

平明工业园区项目规划图

平明工业园区评论

- 工业园区的基础设施规划和投资同步推进:园区内设有港口群和专家宿舍。

- 平明工业园区拥有区域优势:地处人口稠密、劳动力充足、自然资源潜力巨大且食物来源丰富的地区。

- 土地和厂房租金合理,租金灵活且具有竞争力。

- 在平明工业园区投资的企业依法享受投资优惠,并可获得湄公河黄公会的免费法律咨询服务。

- 我们拥有一支热情友好的团队,在工业园区领域拥有丰富的经验,随时准备为企业提供投资前后所有流程方面的咨询服务。

- 由于湄公河三角洲地区正受到国家的高度重视,在交通基础设施建设方面投入了大量资金,因此前往工业园区的交通日益便利,缩短了企业的出行时间。

越南房地产中心的服务

- 工业园区、产业集群和商业服务用地的招商引资(土地、工厂)……

- 工业地产相关领域的法律支持和投资咨询。

- 工业地产投资对接与合作。

联系顾问

Consultant 5 years experience